Wealthsimple Trade Review 2024: Pros, Features and Fees

Pros and Cons of Wealthsimple Trade

Pros

Cons

If you’re looking to put some money in the markets and try Wealthsimple Trade, sign up for an account here and you’ll get a free $25 bonus with your sign up.

Where Wealthsimple Trade Shines

1. No Commission Fees

Most online brokerages, such as Questrade, have trading fees which get charged to an investor every time they buy stocks. Not Wealthsimple Trade though. Wealthsimple Trade’s claim to fame from the very beginning has been that they are a commission free stock trading platform.

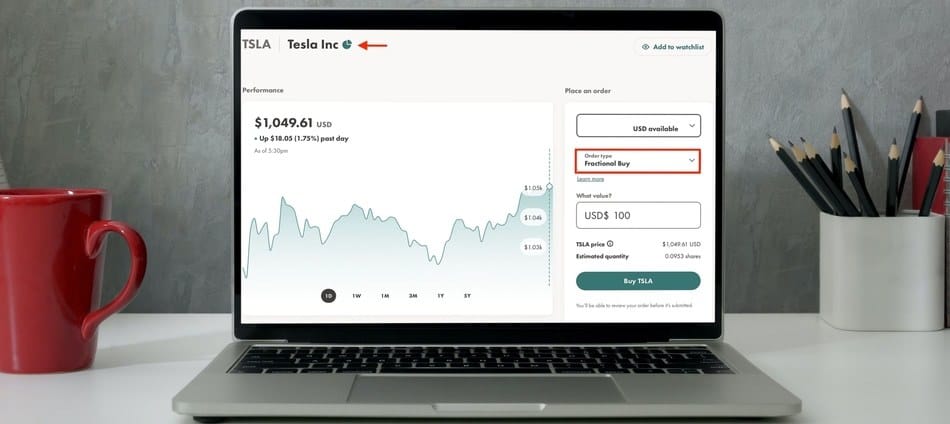

2. Investors Can Buy Fractional Shares

One of the most underrated features of Wealthsimple Trade is that they offer fractional shares. In my opinion, this is something that isn’t talked about nearly enough.

If you’re like most new investors, you don’t have thousands of dollars to invest when you’re first starting out, which, on most platforms, will automatically exclude you from buying high priced stocks like Amazon or Tesla. Wealthsimple Trade however offers whats called Fractional Trading.

This gives investors the ability to buy small fractions of stocks. For example, if you wanted to invest into Tesla, but you didn’t want to spend $805 USD on an entire share, then you could just buy, as an example, 10% of a Tesla share for $80.50. Not only does this help young investors invest in companies they might not be able to if they had to buy an entire share, but it can also help you more easily diversify your investments.

3. No Minimum Deposit Required

Unlike a lot of online stock brokerages, Wealthsimple Trade doesn’t have any minimum deposit requirements when you get started. You can start with as little as $1 and buy a fractional share if you really wanted to.

One of Wealthsimple Trade’s competitors, Questrade, requires a $1,000 minimum deposit before you can start trading on their platform, so Wealthsimple Trade not requiring a minimum deposit is not something we should take for granted. Because let’s be honest, $1,000 is a lot of money and could be a big barrier for someone who wants to get started with investing but doesn’t have that much to begin with.

4. Beginner Friendly App and Desktop Platform

Wealthsimple Trade was built for the masses, and not for the elite Warren Buffett type investors.

For this reason, both the app and desktop version of Wealthsimple Trade is very user friendly. Not only is it SUPER easy to navigate, even for beginners, but as you can see from my short video below (actually buying $10 worth of Tesla stock) the overall design of the trading platform is very sleek and modern – which I for one appreciate!

While I wouldn’t consider myself a beginner, I still don’t want to look a small numbers on big spreadsheets, with dark backgrounds and ugly graphs like you see in the Wall Street movies. So as a Wealthsimple Trade user, the overall design and feel of their platform is just something I really love.

5. Investors Can Trade within TFSAs and RRSPs

Wealthsimple Trade doesn’t just offer personal trading accounts for Canadian investors to invest in, but they also allow users to open up their trading account as a TFSA or an RRSP.

For me personally, I have a TFSA open with Wealthsimple Trade and I love it. The sign up process takes less than 30 minutes start to finish and it’s super easy.

So if you plan to start investing and you don’t have a TFSA or RRSP open yet, look no further than Wealthsimple Trade.

6. Access to the Crypto Markets

If you open up a Wealthsimple Trade account, you’ll get full access to Wealthsimple’s crypto platform too. So if you wanted to get your feet wet with investing in something like Bitcoin or Ethereum, it’s literally as easy as going in and buying a stock.

You don’t need a new app, you don’t need to sign up for anything else, you just get full access to the entire platform by having a Wealthsimple Trade account.

And then the great thing about this is that your investments are all under one roof. You don’t have to manage 2 different platforms, it’s all consolidated for you. No other Canadian brokerage has this capability and it’s honestly something that I don’t think is talked about enough.

If I didn’t already have an account with Wealthsimple Trade, this feature alone would be enough to persuade me.

Recommended Read: Wealthsimple Review June 2023 (For Canadians Only)

Where Wealthsimple Trade Falls Short

1. Desktop Platform Can be Glitchy

As I mentioned above, the Wealthsimple desktop platform is sleek, but if I’m being 100% transparent, it can be glitchy sometimes. As someone who uses the app more then the desktop platform, this isn’t a huge deal, but the few times I do go on my account through the desktop, I have noticed that it is noticeably slower and updates can take longer to process.

2. Deposits Can Take Up to 3 Days to Process

Depending on how much money you plan to deposit into your Wealthsimple Trade account, deposits can sometimes take 3 days to process if you are depositing over $1,500.

If you deposit less than $1,500 then you’ll actually get these funds instantly, but if you plan on depositing thousands of dollars all at once, you can expect to wait a few days until your funds are available to trade. For me, this isn’t a huge deal, because I usually only deposit a few hundred dollars every few weeks, so I never reach that $1,500 max.

Additionally, you can set up automated deposits each month that will automatically transfer funds from your bank into your Wealthsimple Trade account. Auto deposits usually take 3-5 days from your auto deposit date, so if you want to be able to trade your funds on the 15th of every month, setup your auto deposit day for the 10th.

3. No Margin Account Offering

Unlike its competitors such as Questrade, Wealthsimple Trade actually doesn’t offer margin accounts to its investors.

If you are new to investing, you might not even know what a margin account is, which isn’t necessarily a bad thing as there is a lot of risk associated with buying on margin.

Buying on margin is where investors borrow money from their brokerage to invest with. This gives investors more buying power to invest in more stocks. While this can be great if things go well, if your investments done pan out the way you thought they would, well now your in debt.

So if you’re a beginner investor, I wouldn’t factor this con into my decision making process too much, as again, it’s not something I’d recommend new investors take advantage of anyway. However, if you are used to trading on margin and are more of a savy, experienced investor, well then you’ll definitely want to keep this in mind before opening up an account.

4. Currency Conversion Fees

Although Wealthsimple Trade doesn’t charge commission fees when investors purchase stock, they do charge what’s called a currency conversion fee (1.5%) when buying and selling US stocks.

I wouldn’t say this is a hidden fee as they don’t try to hide it, but it’s something that some investors aren’t aware of because when they read commission free trading, they automatically assume it comes at no cost, which isn’t necessarily the case.

Wealthsimple Trade’s 1.5% currency conversion fee is charged every time you buy and sell US stocks. For a complete overview on how this fee is calculated, check out my breakdown below:

With that said, in early 2022, Wealthsimple Trade came out with a premium account called Wealthsimple Trade Plus. This plan comes with a USD account so you actually don’t have to pay a conversion fee when buying and selling US stocks. But will talk about that more later.

5. Not Able to Short Stocks

If you are an experienced investor who likes to short stocks (bet against them), this is likely going to be one of the biggest downsides of Wealthsimple Trade.

As Wealthsimple Trade was built and designed to appeal to the Canadian masses, it doesn’t support some advanced investing strategies like short selling.

If you aren’t familiar with short selling, it’s basically just when an investor bets against a stock from rising. So if the stock goes down in value, the short seller would actually make money. Similar to trading on margin, shorting stocks is very (very, very) risky, and it’s not something I’d recommend, even for some more experienced investors.

Related Article by Noel Moffatt: Can You Short on Wealthsimple? [And How Shorting Works]

6. No RESP Account Offering

Unlike some of Wealthsimple’s competitors, the Wealthsimple Trade platform does not support investors opening RESPs.

An RESP (Retirement Education Savings Plan) is a Canadian registered investment account, similar to an RRSP or TFSA, that parents can open for their children to help get a jump start on saving for their education.

Comprehensive Wealthsimple Trade Analysis

As mentioned at the beginning of this review, I am giving Wealthsimple a 4.5/5 score for their Wealthsimple Stocks and ETFs platform. In this next section below, I go through the grading rubric I use to score Wealthsimple Trade, give each criterion an individual score, and then explain why I think it deserves that rating.

| Analysis | Rating |

|---|---|

| Trading Cost | 4.5 |

| Account Minimums | 5 |

| Fractional Share Capabilities | 5 |

| Crypto Availability | 4.5 |

| Mobile App | 4.5 |

| Investment Offerings | 4 |

| Account Offerings | 3.5 |

| Account Fees | 4.5 |

| Customer Support | 4.5 |

If you’re looking to put some money in the markets and try Wealthsimple Trade, sign up for an account here and you’ll get a free $25 bonus with your sign up.

1. Trading costs

Wealthsimple Trade does not charge the typical commission fees that most online brokerages in Canada charge, which is why I think they deserve a 4.5 star rating here.

However, as mentioned earlier, they do charge a currency conversion fee when buying US listed stocks and ETFs, so while there are no commission fees, there could still be a trading cost associated with your trade depending on what stock you buy.

But why I think Wealthsimple Trade still deserves 4.5 stars here is because this is only on US listed equities, so if you only wanted to buy into Canadian stocks – you would have no trading costs what so ever.

2. Account minimum

This was a pretty easy rating for me to give. Wealthsimple Trade account minimum, or lack thereof, is well deserving of a full 5 star rating here.

They literally have no account minimums, you can start trading with as little as $1.

Unlike it’s competitors, Wealthsimple Trade lets young investors, who may not have thousands, or even hundreds of dollars, get started in the world of investing.

Only have $50 to start investing with? Good luck getting started with any other brokerage outside in Canada besides Wealthsimple Trade.

3. Fractional Share Capabilities

Wealthsimple Trade gets a 5/5 rating here for me as well. Not only did Wealthsimple Trade come out with this feature out of know where, but they managed to pull something off that none of their other major competitors have been able to do yet.

I talked about how this works earlier in the article, but long story short, if you wanted to invest in a company like Tesla but didn’t have $800 to spend, then you could just pick the dollar amount you wanted to invest and you’ll receive the proportionate amount of stock in return.

So if you invested $80 into Tesla which trades at $800, you’d earn 10% of Tesla stock. Pretty straight forward, hey?

From one I can tell, there is only one other online brokerage in Canada that offers fractional shares, being Interactive Brokerage. So the fact that Wealthsimple Trade, a relatively new company still, is able to offer this feature before it’s major competitor (Questrade) and the big banks is really impressive.

4. Crypto availability

The fact that Wealthsimple Trade offers cryptocurrency is awesome. As of May 2022, Wealthsimple offers 40+ different crypto currencies to its users.

What’s even better? Everything lives in one app so you can easily navigate between your Trade and Crypto portfolio. This makes for a great user experience and allows users to easily transfer funds from their trade account to their crypto account.

Not only that, but early in 2022 Wealthsimple Trade came out with crypto wallets for it’s users so now you can send and receive selected crypto currencies from other crypto wallets.

All this to say, Wealthsimple Trade’s crypto functionality isn’t a cookie cutter throw in feature, it’s something they’ve spent a lot of time and resources on over the last few years and it shows.

5. Mobile app

Wealthsimple Trade’s platform is really built for mobile. While they do have a desktop version, which I use sometimes, the app is where I look at my investments more often then not.

Wealthsimple understands that more and more people are accessing information on their mobile devices and have gone all in on their mobile product to make viewing, analyzing and purchasing stocks that much more convenient.

Additionally, the Wealthsimple Trade app allows its users to transfer funds from other Wealthsimple accounts they have. For example, if you are like me and you have a Wealthsimple Cash and Invest account too, then the mobile app will come in handy for you as you’ll be able to transfer funds between all of your accounts without having to withdraw it back into your back acount and then back into another Wealthsimple account.

I love this feature as I’m now able to easily transfer any dividends I earn directly from my Trade account into my spending account (Wealthsimple Cash). And of course, these transfers all come at no cost.

6. Investment offerings

Wealthsimple Trade has never not had a stock I wanted to invest in. All those North American blue chip stocks like Apple, Amazon, Microsoft, Shopify, Scotiabank, RBC, you name it, Wealthsimple Trade will have it.

Wealthsimple Trade doesn’t however support investing in mutual funds, bonds, futures, preferred shares or options. Nor will you find stocks or ETFs that are only listed on non-north American stock exchanges.

So 99% of the people reading this will have no issue with Wealthsimple Trade’s investment offerings, however for that 1% of you who like to invest in random overseas companies, Wealthsimple Trade might not be for you.

7. Account offerings

For account offering, I’m giving Wealthsimple Trade a 3.5.

While they have all the accounts I need and use (Personal, TFSA and RRSP), they don’t support some popular Canadian investment accounts like margin accounts or RESPs.

But again, for a lot of new Wealthsimple Trade users, they just want the basics. They don’t want to trade with borrowed money and they aren’t investing for their children’s education (RESP), so accounts like the TFSA or RRSP are just perfect, and Wealthsimple Trade offers these, which is great.

8. Account fees

Wealthsimple Trade’s account fees are super low and sometimes non-existent, which is why I think this category deserves a 4.5/5.

As I mentioned earlier, there are literally no fees associated with buying Canadian stocks on the Wealthsimple Trade platform.

And while there is a 1.5% currency conversion fee when buying US stocks, the sum of this fee is usually quite small compared to what some commission fees on other platforms cost.

Finally, if you planned to trade US stocks frequently on Wealthsimple Trade, you could subscribe to their Wealthsimple Trade Plus plan for $10 a month and then not pay any other fees whatsoever on all your trades.

So all and all, I think Wealthsimple Trade has a very fair and reasonable fee structure that I don’t think can be matched by any other online Canadian brokerage.

9. Customer support

Wealthsimple’s customer support is world class. Not only can you connect with them in a variety of different ways – Email, phone, chatbot, social media – but their response time is laser quick and the agents I’ve always dealt with have been super friendly and helpful.

The only reason I docked them .5 points is because they are only accessible from 8am-8pm Monday to Friday and 9am-5pm on the weekends (Eastern time). While this isn’t the end of the world by any means, 24/7 customer support is always something I appreciate.

Who Should Use Wealthsimple Trade?

If you are wondering if you should use Wealthsimple Trade or not, to be honest I’m not really sure because I don’t know you, and everyone is different.

And while I personally use and love Wealthsimple for myself, we aren’t the same person and you might have different needs when it comes to what you want in an online brokerage account.

So while I can’t say for sure if YOU should use Wealthsimple Trade, what I can do is tell you the type of investor Wealthsimple Trade is perfect for.

5 Reasons Why You Should Use Wealthsimple Trade

You Should Use Wealthsimple Trade if…

5 Reasons Why Wealthsimple Trade Might Not be For You

Wealthsimple Trade Might Not be For You if…

Key Takeaways and Final Thoughts

The bottom line is that Wealthsimple Trade is an excellent platform for beginner investors who are looking for an easy-to-use platform without the complexities of advanced trading activities. In m opinion, what truly separates Wealthsimple Trade from its Canadian competitors is that they offer fractional shares and direct access to the crypto markets.

And remember that Wealthsimple Trade doesn’t charge commission fees for buying and selling stocks and ETFs, but it does charge currency conversion fees for US-listed equities. So whether you’re an investor with some experience or a complete beginner, you can’t go wrong with Wealthsimple Trade.

I’ve personally been using Wealthsimple Trade since the early days and was even a beta user (used it before the product was launched to the public). To see the progress this app and software has made since 2019 has been incredible – and I have no doubt they will continue to innovate and make the product even better as time goes on.

If you wanted to get started with investing, my suggestion would be to at least try them out. And heck, if you don’t like it, withdraw your funds and try another brokerage.

That’s all I got! Hopefully this article, if nothing else, will help you make an informed decision on whether or not you want to use (or try) Wealthsimple Trade.

FAQs about Wealthsimple Trade

Wealthsimple Trade Plus is Wealthsimple’s premium plan for their online brokerage, costing $10 per month. For $10 a month what you get is a USD account. So that way you only have to convert your funds to USD one time and not every time you buy and sell a US stock or ETF. To be 100% honest, this plan will only make sense for you if you plan on buying (and selling) stocks a few times per month. For more information about Wealthsimple Trade Plus, here is Wealthsimple’s article on it.

Yes, Canadian investors can day trade on the Wealthsimple Trade platform. Not only is it completely legal, but it is also completely compliant with Wealthsimple’s policies. However, just because you can, this doesn’t mean you should.

Wealthsimple Trade makes money in two ways. One way is by charging $10 per month to its Wealthsimple Trade Plus customers, and the other is by charging what’s referred to as a currency conversion fee.

Yes, Wealthsimple Trade is safe. Not only is the software fully secured with state-of-the-art encryption, cloud back-ups, a world class security team, 2-factor verification and product-led threat detection in the code. but its brokerage partner Wealthsimple Investments Inc. is insured by the CIPF and regulated by the IIROC, protecting your funds in the event of fraud or even insolvency. Check out my full in-depth article here on the safeness and legitimacy of Wealthsimple Trade.

Log in to your Wealthsimple app and click the “$” on the bottom middle of your screen, then click “Move funds.” Then you’ll click “Withdraw” in the top middle of your phone screen. From there, you’ll select what account you want these funds to be withdrawn from (if you have more than one account), where you want the funds to be deposited, and of course, how much you want to withdraw. Finally, click “Submit Withdrawal,” and you’re done!

Besides buying some dividend-paying stocks (or ETFs), you don’t have to do anything else. When the company you invested in issues it dividends, you’ll get that money directly deposited into your Trade account as cash. You can then do as you please with it. You could leave it in cash in your Trade account, reinvest it, or withdraw it to your bank account. That is up to you!

Wealthsimple Trade allows Canadian investors to trade US and Canadian stocks and ETFs. US stocks need to be CDS-Eligible for Wealthsimple to be able to offer them to investors. CDS or Canadian Depository for Securities Limited, is the national securities depository and a clearing house for foreign stocks.

![Can You Buy Index Funds on Wealthsimple? [And How To Do It]](https://noelmoffatt.com/wp-content/uploads/2023/08/Can-You-Buy-Index-Funds-on-Wealthsimple.jpg)

![Wealthsimple Crypto Review January 2024 [My Honest Opinion]](https://noelmoffatt.com/wp-content/uploads/2023/04/Wealthsimple-Crypto-Review-768x384.jpg)

![How to Withdraw Money from Wealthsimple [with Screenshots]](https://noelmoffatt.com/wp-content/uploads/2023/07/How-to-Withdraw-Money-from-Wealthsimple-768x327.jpg)