Can You Short on Wealthsimple? [And How Shorting Works]

If you’re wondering whether you can short stocks or ETFs on Wealthsimple, then this article has you covered as we cover this topic in depth.

First things first, Wealthsimple has five different products, and Wealthsimple Trade is its online brokerage where you can buy and sell stocks and ETFs.

Wealthsimple’s flagship product, Wealthsimple Invest, is a robo advisor, and shorting a stock with a robo-advisor isn’t really a thing. So whenever we mention Wealthsimple throughout this article, just know we’re talking about the Trade platform.

Related Article by Noel: Wealthsimple Invest vs Trade 2023 | Which is Right For You?

Okay, let’s get into it.

Can You Short Stocks on Wealthsimple Trade?

Wealthsimple Trade is an innovative investing platform popular with younger Canadian investors who appreciate a modern, online, simplified approach to buying and selling equities (stocks and ETFs).

For those looking to short-sell a particular stock or index, Wealthsimple Trade currently does not offer that option. In fact, after reaching out to Wealthsimple directly, their Customer Support affirmed, “Short selling is not supported on Wealthsimple.”

While Wealthsimple allows for buying and selling of stocks, ETFs, cryptocurrencies, and as of early 2023, options trading, this is not the same as options trading.

If you don’t have a Wealthsimple Trade account, you can use our partnership link here to give it a try, not only is it 100% free to sign up, but signing up with us will actually get you $25 to get started -so no pressure either way, but just so you know!

Sign up here and claim your $25 bonus (you can buy fractional shares on Wealthsimple Trade too).

What Exactly is Shorting a Stock?

Let’s be honest – short selling is often regarded negatively in the investing world.

The logic behind this sentiment is that most investors are long-term focused, profiting when their stocks’ prices rise. Short sellers, on the other hand, seek profit from the decline in a stock’s price, which can happen due to many reasons, such as things like overvaluation, long-term instability, or macroeconomic factors.

So short selling basically involves borrowing shares to sell them at the current market price, hoping to buy them back at a lower price later. The difference in the buying and selling prices becomes the short seller’s profit.

Here’s an example:

- Borrowing Shares: Let’s say you, as an investor, have researched and believe that Apple’s stock is overvalued and will decrease in the near future. The current market price for Apple is $200 per share. You decide to short sell 100 shares. To do this, you would borrow the 100 shares from your brokerage (who owns or borrows them from another client’s holdings) and immediately sell them in the open market.

- Selling the Shares: After borrowing the 100 shares, you sell them all at the current market price of $200 each. Your account now holds $20,000 in cash ($200 * 100), but you are also obligated to return 100 shares of Apple to your broker at some point in the future.

- The Price Drops: Over the next couple of months, let’s say your prediction was correct and the price of Apple’s stock drops to $150 per share due to market conditions.

- Buying Back the Shares: You decide it’s time to close your short position, so you buy back the 100 shares at the new lower price, costing $15,000 ($150 * 100).

- Returning the Shares: You then return the 100 shares to your brokerage, fulfilling your obligation.

- Profit: Your profit in this scenario would be the money you initially received from selling the borrowed shares minus the money you spent buying them back. That is $20,000 – $15,000 = $5,000.

It’s important to note that short selling is a highly advanced and risky trading strategy. The risk stems from the potential for infinite losses if the stock price continues to rise instead of falling. For this reason, it just doesn’t;t make sense for platforms like Wealthsimple Trade, which cater to beginner investors, to offer short selling capabilities.

But even with that being said, while you can’t short-sell stocks on Wealthsimple, you can buy put options, a similar investment strategy. However, even with options, remember that it’s always so crucial to understand the risks involved before engaging in these advanced and potentially risky trading strategies.

How Could You Short a Stock Using Wealthsimple Trade?

As you now know, Wealthsimple Trade doesn’t offer the traditional method of shorting stocks directly. However, there are some alternative methods available on the platform which can act as a workaround.

1. Buy Inverse ETFs

One method is purchasing inverse Exchange Traded Funds (ETFs), such as the ProShares UltraPro Short S&P500. An inverse ETF [1] is a fund that tries to achieve returns that are the opposite of its benchmark index.

For example, if the S&P500 index falls in value, then the ProShares UltraPro Short S&P500 ETF should rise in value, effectively mimicking the results of shorting the index.

This method is 100% feasible and easy to do on Wealthsimple Trade, which is why it’s my #1 workaround for shorting stocks. (10-minute signup process here with Wealthsimple Trade)

Check out this great video below where it explains how you can short stocks by using an inverse ETF within Wealthsimple Trade (fast forward to 2:25 if you’re in a hurry)

2. Buy Put Options Through Wealthsimple

While they are not identical to short selling, they are similar in the sense that they offer the potential for profit if the underlying stock falls in price.

We talk more about options with Wealthsimple a little later in this article, but in early 2023, Wealthsimple released its Options feature to the Trade platform [2].

In short, a put option gives the holder the right, but not the obligation, to sell a specific amount of an underlying security at a specified price within a specified time frame.

This can be a strategic way to bet against a stock, but it requires a solid understanding of how options work.

And lastly, before we move on, remember that these alternatives also come with their own risks and may not be suitable for all investors, so it’s always important to do your own research and consider consulting with a financial advisor before making any of these types of investment decisions.

Now no worries either way, but as mentioned above – if you did want to buy put options using Wealthsimple Trade, you can sign up here and get $25 with your sign-up. It’s the exact same sign-up process either way, but with my partnership link, you’ll get an extra $25.

The Risks Of Short Selling Stocks

While short selling can be a potential strategy for investors to profit from falling stock prices, it carries significant risks. It’s crucial to keep these risks in mind when considering investment strategies on platforms like Wealthsimple.

Though Wealthsimple doesn’t currently offer short selling, it does provide options trading, which can be used to create similar market positions.

Let’s explore these risks:

Potential for Unlimited Losses

When buying stocks, your potential loss is limited to your initial investment. However, with short selling, investors expose themselves to potentially unlimited losses. This is because there’s no upper limit to how high a stock’s price can climb. If a stock’s price surges, the short seller must cover their position at that elevated price, leading to potentially substantial losses.

Short Squeezes

A short squeeze is another considerable risk for short sellers. This situation arises when a heavily shorted stock’s price unexpectedly spikes. This causes short sellers to buy the stock to cover their positions, further increasing the price. Even though short selling isn’t offered on Wealthsimple, similar scenarios can occur in certain options strategies where market participants are betting on falling prices.

Regulatory Risks

Regulators might sometimes impose bans on short sales in a specific sector or even the entire market to avoid panic and unwarranted selling pressure. These abrupt actions can lead to an immediate rise in stock prices, causing a short sellers to incur significant losses as they cover their positions. While this is not a direct concern for Wealthsimple users, given the platform’s current trading options, it’s important to understand the overall market dynamics.

Market Trends

Historically, the stock market tends to rise over time. This means short sellers are often going against the overall market trend. This risk applies to all bearish strategies, including certain options strategies available on Wealthsimple.

Margin Risks and Interest

Short selling typically requires a margin account, which allows investors to borrow money or stocks. However, the interest charged on this borrowed money can add to losses if the trade goes against the investor. While short selling isn’t available on Wealthsimple, margin trading for certain securities is, and similar considerations apply.

Timing and Costs

Even if a stock is overvalued, it could take some time for its price to decline. Meanwhile, you might incur costs such as margin interest or other fees. Even with Wealthsimple’s low-cost approach to trading, options that are used to bet against a stock require careful management and may incur costs.

Understanding these risks associated with short selling can help you make informed decisions about your investment strategies, even when trading options on platforms like Wealthsimple

Can you short on Questrade?

While Wealthsimple currently doesn’t support short selling, Questrade, another popular Canadian trading platform, does provide this capability on their Questrade Edge platform.

Here’s what you need to know:

Questrade is one of the most well-known online brokerages in Canada and stands out from the crowd because it allows its users to short sell stocks. To do this, you’ll first need to have a Questrade Edge account [3] (a more advanced platform), and then all you do is simply place a sell order for shares you don’t currently own in an account that permits short selling.

A prompt will then appear to warn you about the action you’re taking, reminding you of the costs and risks involved and providing further instructions on how to short that specific stock.

Zak Hartley breaks this process down really nicely in his video here.

There are a few key considerations to remember when shorting stocks on Questrade:

- A margin account is necessary: Questrade will continuously oversee the account to ensure you meet the minimum credit requirements for your short position.

- You must borrow the shares: To short a stock, you must borrow the shares from Questrade. And be aware that fees may apply when borrowing securities to short!

Typically, there are no specific rules on how long you can keep borrowed shares before needing to return them. But you should definitely be prepared for the possibility that Questrade could recall the borrowed shares at any time, requiring you to promptly cover your short position by buying and returning the shares.

Let’s illustrate this with an example:

- You decide to short Microsoft (MSFT), and you borrow 50 shares and sell them the next day.

- If the share price at the end of the day is $200, your total short position equals $10,000.

- If there’s a high demand for the stock and your borrow rate is set at 15%, your borrow fee for the day would be calculated as (15% x $10,000) / 365, which equates to approximately $4.11.

Remember, the borrowing rate shown in the agreement is an estimate, and the availability of the position isn’t guaranteed for the entire duration you intend to hold the short position. Questrade, or you might have to buy back the shares to close the short position if the borrowed shares are recalled.

So the bottom line here, unlike Wealthsimple, Questrade does allow for short selling, but always remember the risks involved and make sure you’re prepared for any sudden changes in your positions.

How does Wealthsimple Compare to Questrade?

Firstly, as of mid-2023, Wealthsimple Trade does not support short-selling securities.

This means that if you’re looking to profit from a decline in a specific security’s price through short selling, Wealthsimple may not be the best platform for your needs.

That said, though, as mentioned above, Wealthsimple has recently introduced options trading, including the ability to buy put options, a financial maneuver similar in concept to short selling, allowing you to profit if the price of a stock drops.

On the other hand, Questrade offers more comprehensive trading options, including the ability to short sell stocks.

So if you’re interested in more sophisticated investment strategies, like short selling or trading on margin, Questrade may be the better platform for you. However, I’ll mention it again, keep in mind that these strategies come with higher risks and could potentially result in significant financial loss if not managed properly.

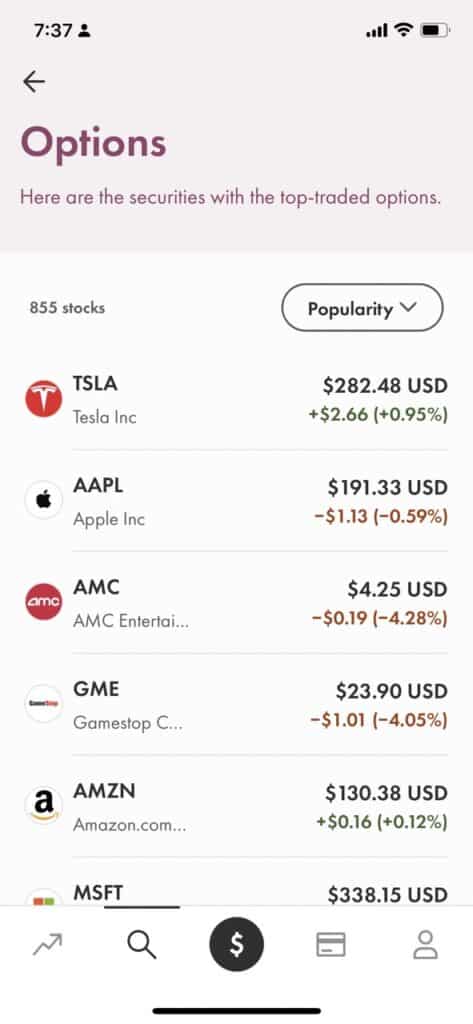

Trading Options with Wealthsimple

In the quest to understand alternative investing methods beyond the traditional buying and holding of securities, you might have come across the concept of options trading.

While options trading is not exactly the same as short selling, it does offer another path for investors who anticipate changes in a security’s price, either upward or downward.

New Wealthsimple users are now provided with the ability to trade options, specifically long call and long put options. So if that’s something you were looking at doing, you can sign up for Wealthsimple Trade here – the entire signup process takes about 10 minutes and as mentioned above you’ll get a $25 bonus with your sign up.

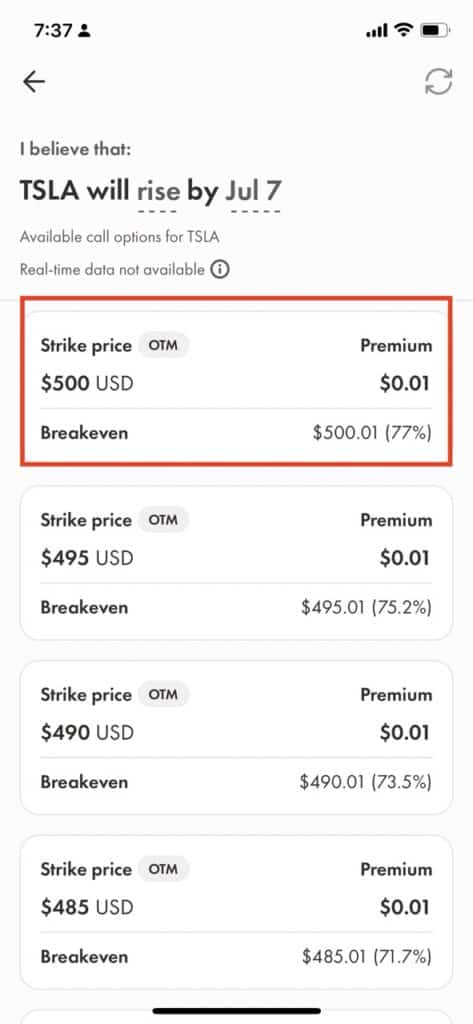

Long call options, one of the two options trading strategies on Wealthsimple, provide you with the right (but not an obligation) to buy a stock at a specified price, known as the strike price, on or before a certain date, known as the expiry date.

This type of option can be beneficial if you anticipate that the price of a stock will increase in the future.

On the other hand, long put options allow you to sell a stock at the strike price on or before the expiry date.

These are advantageous if you predict a decrease in the stock’s price. Both types of options come with an upfront cost, the premium, which reflects the cost per share times 100, as a single options contract typically represents 100 shares of the underlying stock.

In trading options, you’ll come across terms describing the current state of your options:

In-the-money: This term describes when an option is profitable to execute.

At-the-money: This term indicates an option’s strike price equal to the current market price of the underlying asset.

Out-of-the-money: This term describes an option that is currently not profitable to execute.

Although Wealthsimple does not directly offer the ability to short stocks, the option to long put options indirectly allows for a very similar outcome. So if you predict a stock’s price will decrease, purchasing a long put option can potentially yield profits when your prediction comes true.

Just remember, options trading carries its own unique risks and is certainly not suitable for all investors. Therefore, it’s crucial to understand the mechanism fully and consider your risk tolerance before diving in.

Conclusion: Can You Short Stocks Using Wealthsimple?

To sum everything up on whether or not you can short stocks using Wealthsimple, the answer is not through the traditional direct method.

While the Wealthsimple Trade platform does not currently support short selling, it offers options trading and hosts ETFs on the platform that act as an inverse to the underlying security, very similar to short selling.

Thanks for reading!

![Can I Buy US Stocks on Wealthsimple? [Guide with Screenshots]](https://noelmoffatt.com/wp-content/uploads/2023/08/How-to-Buy-US-Stocks-on-Wealthsimple-Medium.jpeg)

![How To Buy Dividend Stocks On Wealthsimple [2024 Tutorial]](https://noelmoffatt.com/wp-content/uploads/2023/08/How-tp-Buy-Dividend-Stocks-on-Wealthsimple-768x538.jpg)

![Wealthsimple Cash Review: Worth the Hype? [January 2024]](https://noelmoffatt.com/wp-content/uploads/2023/03/Wealthsimple-Cash-Review-1-1-768x384.jpg)