Wealthsimple FHSA 2024 Guide | First Home Savings Account

Canada’s financial landscape continues to evolve, and the First Home Savings Account (FHSA) has recently emerged as the most sought-after investment vehicle on the market for potential homeowners.

Launched in 2023, the FHSA has quickly become a big hit, and it’s no wonder why, given the fact that so many eligible Canadians are looking to put a down payment on their first home.

As a long-time Wealthsimple user and someone who has reviewed the platform for a long time, I had the unique opportunity to be on the waitlist for their First Home Savings Account (FHSA) account offering and was fortunate to gain early access.

Within this guide, I’m going to dive deep into its details, benefits, and how Wealthsimple’s FHSA stands tall when compared to other investment vehicles like the TFSA (Tax-Free Savings Account) and RRSP (Registered Retirement Savings Plan).

From understanding its sign-up criteria to exploring its potential challenges, we’ll walk you through the ins and outs of Wealthsimple’s FHSA offering.

Whether you’re a first-time home buyer weighing your options or a personal finance geek just looking to understand what’s new in the market, this comprehensive overview has got you covered.

Are FHSAs Available on Wealthsimple?

Yes, they are – As of August 2023, Wealthsimple has begun offering its eligible users the opportunity to open an FHSA account on their platform.

Wealthsimple also provides a choice that caters to both of its investor types. For those of you who don’t know, Wealthsimple has two investing platforms, Wealthsimple Invest and Wealthsimple Trade.

Wealthsimple Invest is its managed investing platform (0.5% management fees), whereas Wealthsimple Trade is its “do-it-yourself’ investing platform (no management fees) – so depending on your comfort level and investing strategy, you can select either platform to open an FHSA.

Criteria for Opening a Wealthsimple FHSA

Now, you may have noticed above I stated “offering its eligible users” because the fact of the matter is not everyone is eligible to open an FHSA.

So, before diving into your new financial journey of opening an FHSA, it’s essential to ensure you fit the eligibility criteria to maximize the benefits offered.

Here’s a comprehensive breakdown of the basic criteria you need to fit in order to open an FHSA.

Basic Eligibility Requirements:

- Home Ownership Status: The FHSA targets specifically those buying a home for the first time.

- Residency: Canadian resident

- Age Limit: 18 – 71 years old

Defining a First-Time Home Buyer:

According to the Canada Revenue Agency:

- A first-time home buyer is someone who hasn’t owned a home in which they’ve lived during the calendar year they open an FHSA.

- Moreover, they shouldn’t have lived in a home owned by them or their spouse in the preceding four calendar years the FHSA’s opening year.

Eligible Investments within a Wealthsimple FHSA

Wealthsimple’s FHSA is designed to help Canadians save more money effectively for their dream home through its flexible and tax-advantaged structure. Recognizing the diverse investment options available within this FHSA is key to tapping into its full potential benefits.

What Can You Invest in with a FHSA?

- Stocks: Representing shares of a company, stocks give you a piece of ownership in that company. They can provide significant growth over time but come with higher volatility.

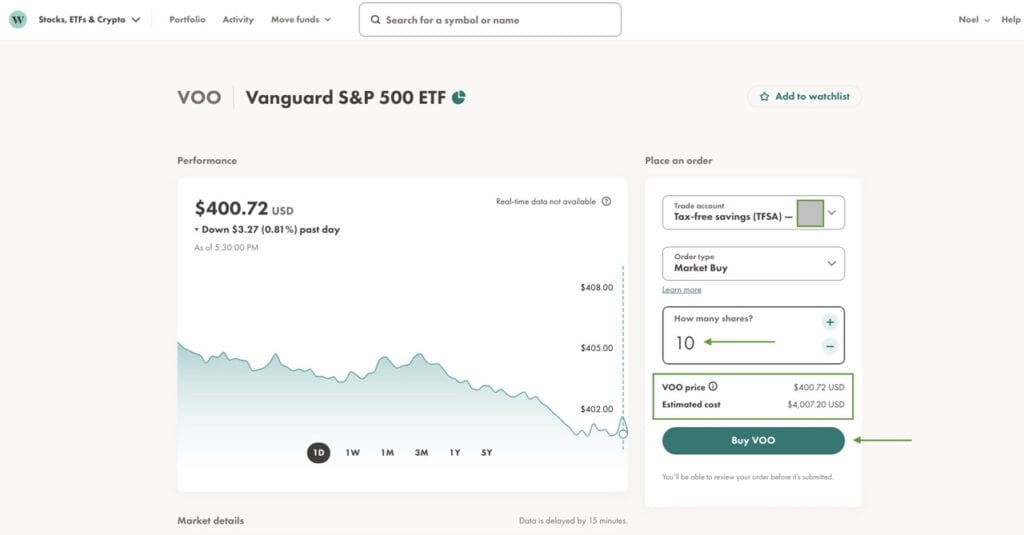

- Exchange-Traded Funds (ETFs): These are diversified collections of assets, like stocks, bonds, or commodities. ETFs allow you to have broad market exposure, which can provide a balance between growth and risk. (Guide on Investing in ETFs on Wealthsimple)

- Cash (savings): If you’d prefer to save money, you can do that too. While it might not provide the growth that other assets could, it is the safest in terms of preserving capital.

- Bonds: Bonds represent loans made by investors to entities (like governments or corporate bonds). They usually offer steady income through interest payments and are considered less risky than stocks. (Guide on Investing in Bonds on Wealthsimple)

- Mutual Funds: Funds held in a mutual fund are pooled funds that are managed by professionals. They can consist of stocks, bonds, or other assets, and they provide diversification, which can reduce risk.

- High-Interest Savings Accounts (HISAs): You can expect that most HISAs pays interest rates that are higher than regular savings accounts, making them a decent option for those wanting a safe place for their money with the ability to earn tax free interest income.

- Guaranteed Investment Certificates (GICs): GICs are low-risk investments that offer guaranteed returns over a set period. They are suitable for those who want to ensure their principal amount remains intact. (GIC Alternatives On Wealthsimple)

Balancing Risk and Growth in an FHSA

Given the shorter investment horizon of the FHSA compared to other accounts, like the TFSA or RRSP, potential investors need to be strategic. It’s essential to balance between seeking growth to maximize the benefit of tax-free capital gains tax and ensuring the capital is not at a high risk of loss, especially as the time to purchase a home approaches.

For those new to investing, it may be wise to consult with a financial advisor or utilize robo advisor services like those offered by Wealthsimple, as they can help tailor an investment strategy that aligns with your down payment and purchase goals while managing your risk tolerance.

Wealthsimple FHSA: Pros and Cons

Pros

- Tax deductible contributions, which effectively reduce your annual taxable income.

- Earnings within the account (e.g., from stocks bonds) can be withdrawn tax free for a home purchase.

- Flexibility in investment choices: stocks, ETFs, mutual funds, GICs, and more.

- Unlike the RRSP’s Home Buyers Plan, there is no need to repay withdrawals used for the first house purchase.

- Unused contribution room from the previous year will carry forward

Cons

- Has a time limit – If not used within 15 years of opening, decisions on transfer or withdrawal must be made.

- $8,000 annual total contribution room, with a lifetime limit of $40,000 lifetime.

- Limited to first-home buyers – If you’ve owned a home before, you’re ineligible.

- If not used for home purchase, tax implications or transfer requirements may apply.

Having understood the merits and potential pitfalls of the FHSA program, now let’s look at how it stands up relative to Canada’s other investment vehicles – the RRSP and TFSA.

Comparing Wealthsimple FHSA, TFSA, and RRSP

Different investment accounts cater to varying needs and financial goals. Let’s break down the key features of the Wealthsimple FHSA, TFSA, and RRSP to better understand which might suit your circumstances:

| Features | FHSA | RRSP | TFSA |

| Contribution Limit (2023) | $8,000 annually, $40,000 lifetime | 18% of previous year’s earned income, up to $30,780 | $6,500 annually ($88,000 total since 2009) |

| Over-Contribution Penalty | 1% monthly on excess FHSA contributions | 1% monthly on the excess above $ 2,000-lifetime buffer | 1% monthly on excess deposits above the contribution room |

| Withdrawals | Tax-free for home purchases | Taxed upon withdrawal | Completely tax-free |

| Account Expiry | After 15 years or age 71 | Must convert to RRIF at age 71 | None |

| Earnings Treatment | Tax-free | Tax-deferred | Tax-free |

| Tax Deductible Contributions | Yes | Yes | No |

| Eligible Investments | Stocks, ETFs, mutual funds, bonds, GICs, savings deposit | Stocks, ETFs, mutual funds, bonds, GICs, savings deposits | Stocks, ETFs, mutual funds, bonds, GICs, savings deposits |

With the key features of these investment accounts highlighted, let’s now dive deeper into how the FHSA interacts with another plan that Canadians save money in before home purchasing: the Home Buyer’s Plan (part of the RRSP).

Understanding FHSA in Relation to the Home Buyer’s Plan

When considering the purchase of a first house in Canada, two powerful financial tools come to the forefront: the FHSA and the Home Buyer’s Plan (HBP). While both provide avenues to access funds for home buying, they come with distinct rules and benefits.

1. Nature of the Programs:

The HBP operates under the RRSP (a registered account), letting potential homeowners borrow up to $35,000 from their RRSP for home acquisition. If two individuals are purchasing together, they can jointly pull out up to $70,000 ($35,000 each).

2. Repayment Dynamics:

One major distinction between the two programs centers on their repayment obligations. With the HBP, there’s a stipulation that the withdrawn funds be returned to the RRSP within a span of 15 years. In contrast, the FHSA allows for funds to be utilized for a home purchase without imposing a specific repayment mandate.

3. Tax Deductibility:

Contributions made to both the RRSP, from which the HBP withdrawal is pulled from, and FHSA accounts are also accompanied by these tax deductibility benefits. However, while you might have additional RRSP contribution room to carry forward, there is limited RRSP and FHSA contribution room. In essence, the money you channel into these accounts can be deducted from your yearly taxable income, affording you immediate tax relief.

4. Combined Use:

For those considering how the account combines to leverage the advantages of both tools for a singular house purchase, the answer is positively, as you can merge funds from the FHSA with those from an HBP withdrawal and amplify your financial resources for your first home purchase in Canada.

So, to summarize, while both FHSA and the HBP provide prospective homeowners with substantial benefits, understanding their nuanced differences ensures that you make an informed choice tailored to your financial situation and goals.

What are the Disadvantages of the FHSA?

The FHSA undeniably offers numerous benefits to prospective homeowners. Yet, as with most financial instruments, it’s not exempt from critique. Let’s delve into some of the challenges often associated with this initiative:

- Limited Scope: The FHSA specifically caters to first-time homebuyers, which may exclude many potential beneficiaries who are looking to purchase subsequent homes.

- Economic Disparities: FHSAs might disproportionately favour those in higher personal income brackets. These individuals could make maximum contributions, reaping the full tax benefits, whereas those in lower income tiers may not have the means to contribute as significantly and will deposit well under what they have as contribution room.

- Complexity for Users: Managing yet another savings account, especially with its distinct rules and conditions, could prove complex for some users, potentially deterring them from utilizing the FHSA to its fullest potential.

FAQs About the FHSA

Should I Open an FHSA or TFSA first?

When deciding whether you should open an FHSA or TFSA, first consider your primary financial objectives. If your primary goal is purchasing your first home, an FHSA might be the better choice due to its specific advantages for first-time homebuyers. However, if you seek versatility in investment and withdrawal options, a tax-free savings account may be more fitting.

Can You Withdraw From FHSA on Wealthsimple?

Yes, withdrawing from your FHSA on Wealthsimple is straightforward. Begin with the initial procedures of a regular withdrawal. As you progress through the process, adhere to the on-screen prompts to confirm your eligibility for a qualified withdrawal. Keep in mind that the duration for completing qualified withdrawals aligns with the timelines of standard withdrawals, and always ensure your eligibility before proceeding.

Is the FHSA Available in Canada?

Yes, the FHSA is indeed available in Canada. Questrade pioneered its introduction on April 1. Following its footsteps were other major institutions such as RBC, Wealthsimple, TD, EQ Bank, Fidelity Investments, Scotiabank, and National Bank of Canada, which have also launched their FHSAs.

Can I Save for a Down Payment in a FHSA if I Already Own a Home?

When it comes to FHSAs, understanding what qualifies as a qualifying home is essential. If either you or your spouse (or common-law partner) have resided in a home you owned during the current year or any of the past four calendar years, you are ineligible to initiate an FHSA or carry out a tax-free withdrawal. Tax-free withdrawals are only permissible when purchasing a qualifying residence.

Which Banks Have the FHSA?

Among the major banks in Canada, TD, Scotiabank, CIBC, RBC, and the National Bank currently offer FHSAs. BMO has announced plans to introduce their FHSAs later in the year. Apart from these major banks themselves, individuals can also establish an FHSA through other FHSA issuers, including credit unions, insurance companies, or financial institutions.

![Can I Buy US Stocks on Wealthsimple? [Guide with Screenshots]](https://noelmoffatt.com/wp-content/uploads/2023/08/How-to-Buy-US-Stocks-on-Wealthsimple-Medium.jpeg)