Can I Buy US Stocks on Wealthsimple? [Guide with Screenshots]

If You’re In a Rush

Can I Buy US Stocks on Wealthsimple?

Yes, you can buy US stocks on Wealthsimple through their Wealthsimple Trade platform.

Are you a Canadian investor looking to invest in some US stocks like Apple, Telsa, Microsoft, or maybe something like Amazon? Just to name a few.

Because let’s be honest, while there are lots of great Canadian companies and tech stocks to invest in, like Telus, RBC, Fortis, and Shopify, the majority of the big players set up shop in the US.

For Canadian investors on Wealthsimple or for those considering the trading platform, they may wonder if Wealthsimple provides the option to purchase US stocks, as it would significantly influence their decision to use the platform or not.

These are all questions Canadian investors want to know, so let’s address them right away.

Yes, you can buy US stocks on Wealthsimple through their Wealthsimple Trade platform. With a self-directed trading account, investors have the ability to trade thousands of Canadian and U.S. stocks and ETFs. Notably, there are no account minimums, no commission fees, and every user gets access to real-time, on-demand quotes for all securities.

Basic Wealthsimple Trade Account vs Wealthsimple Trade USD Account

So now that you know you can, in fact, buy US stocks on Wealthsimple, let’s dive into this topic more and quickly explain to you the difference between the two types of Wealthsimple Trade accounts, followed by a step-by-step guide on how to buy US stocks on the Wealthsimple Trade platform.

Wealthsimple Trade Basic

The Wealthsimple Trade Basic account is a no-frills trading option for all Canadian and U.S stocks and it comes at no monthly cost to the user. When trading U.S. stocks, users won’t face any commission charges either. However, they will incur a 1.5% foreign-exchange fee every time there is a transaction involving a conversion from CAD to USD and vice versa. This is because the basic accounts are solely set up to support Canadian dollars.

If you only plan to buy Canadian stocks and invest in the Canadian market, Wealthsimple Trade Basic is all you’ll need.

Wealthsimple Trade Plus

On the other hand, the Wealthsimple Plus[1] account is a more premium offering that come with a monthly fee of $10. What sets it apart from the basic plan is that it supports USD accounts. This means that users only face the 1.5% conversion fee when they’re converting CAD to USD to fund their accounts (or vise versa).

After this initial conversion, they won’t face any additional cost or conversion fees when trading U.S. stocks, making it a cost-effective option for frequent traders of U.S. stocks.

I personally use Wealthsimple Plus, partly so I could test it out but also partly because I don’t like paying the conversion fees every single time I buy or sell an asset.

How to Buy US Stocks on Wealthsimple

Okay, so we know that we can buy US stocks on Wealthsimple Trade, and we understand the difference between the Basic and Plus versions – now I’m going to walk you through an example of me buying a Tesla stock on my Wealthsimple Trade Plus account (USD Account).

I’ll be doing this on my Wealthsimple Trade app, but if you prefer using a desktop device, don’t worry; the steps are essentially identical.

Step-by-Step Guide

Step #1

Login to Your Wealthsimple Trade AccountStep #2

Use The Search Bar To Look For the Stock You Want to BuyStep #3

Click Buy And Select The Number Of Shares You Want To PurchaseStep #4

Look Over the Purchase Details And Confirm the OrderStep #5

Click Done

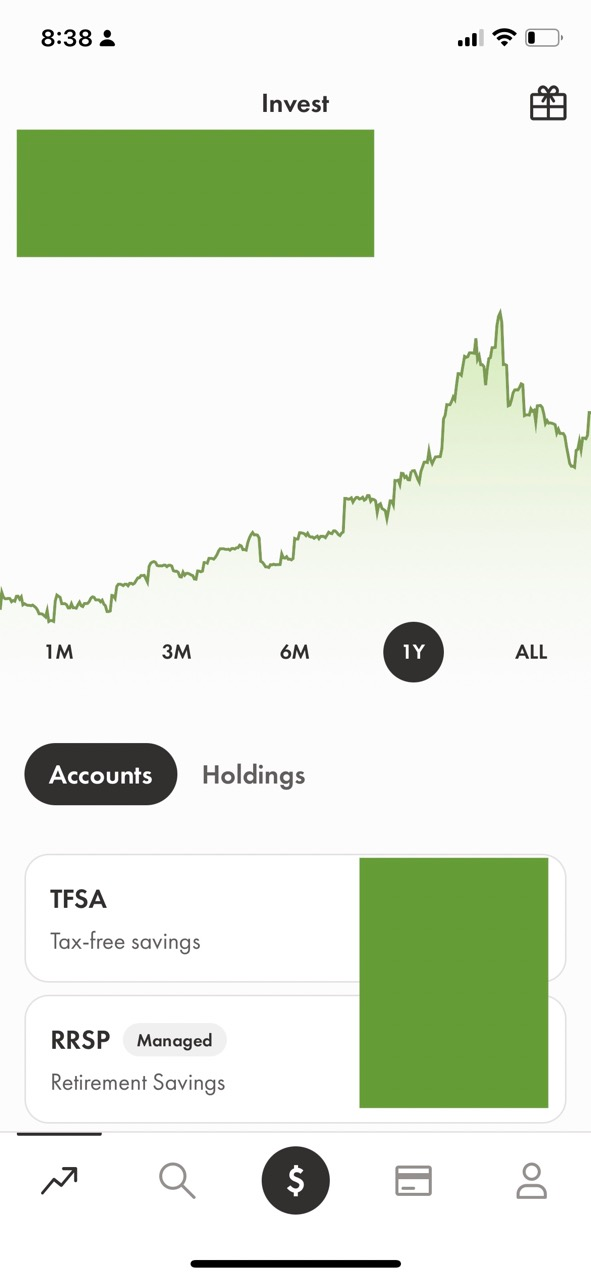

Step #1 – Login To Your Wealthsimple Trade Account

To start trading, sign in to your Wealthsimple Trade account.

If you’re new and don’t have an account yet, you can easily sign up here. Honestly. the entire sign-up process is super straightforward and can probably be completed in less than 15 minutes.

After setting up and accessing your account, your display should resemble the one I’ve provided below (with some sections blurred for confidentiality).

Now, on to step #2.

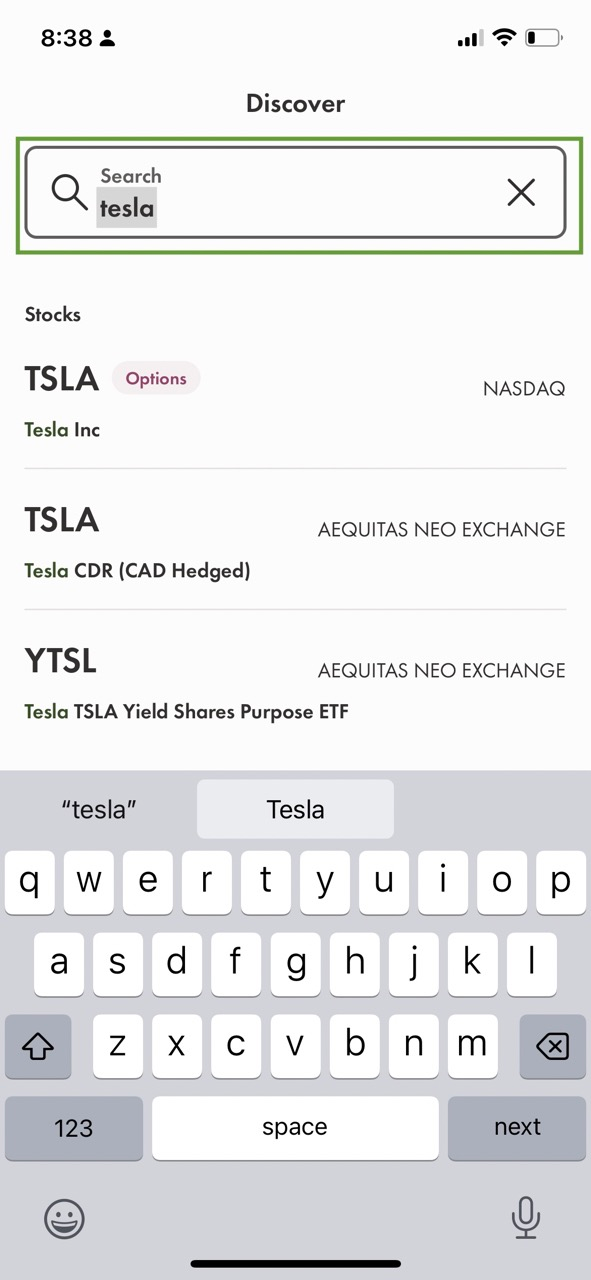

Step #2 – Use The Search Bar To Look For the Stock You Want to Buy

Okay, now go to the search bar here and search for the stock you want to buy. For me, as mentioned above, I’m going to buy a share of Tesla[2] .

So I’ll search Tesla, and you’ll see it comes up here for me to click.

Once you select the US stock you want to buy, you’ll be brought to the trading page, which you’ll see in the next section.

But before going to that, I also want to show you a quick video below, which will show you how to actually go to a US Stock section of the app where you can just scroll all the top US stocks available on the trading platform.

This is a great user experience for someone who isn’t quite sure what stock they want to buy yet.

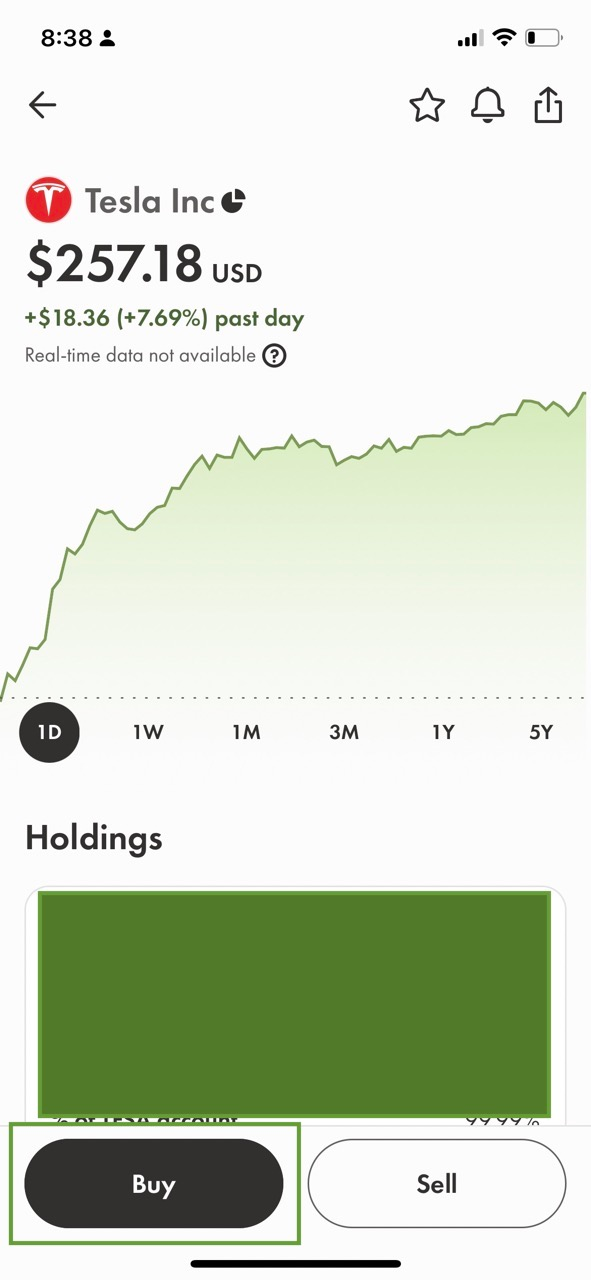

Step #3 – Click Buy and Select The Number Of Shares You Want To Purchase

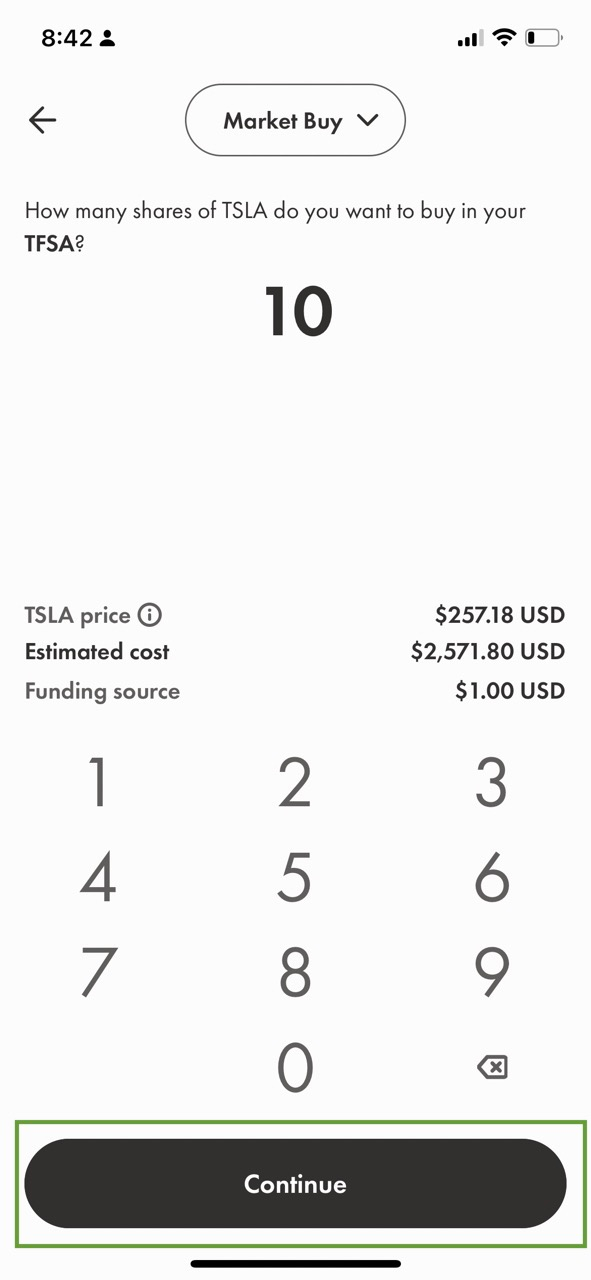

Once you get to the screen I’m on now, all you do is click buy and then select the number of shares you want to purchase, followed by “Continue.”

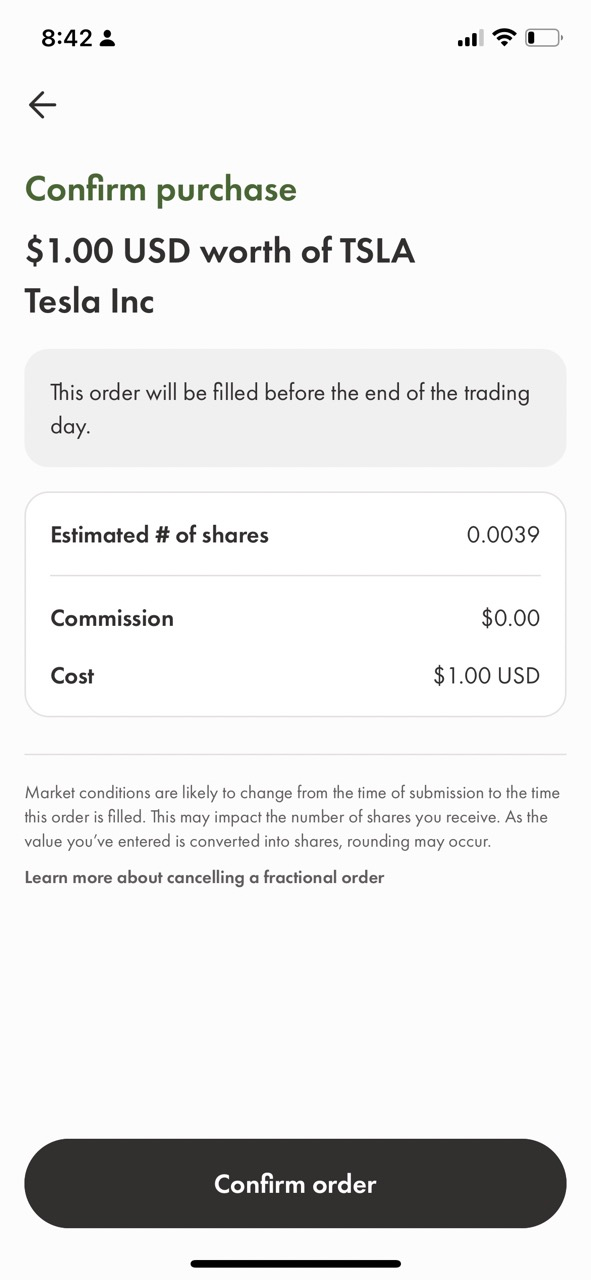

Step #4 – Look Over Purchase Details And Confirm Order

Once you’ve made your decision on what stock to buy and the quantity of it, click confirm order. As you’ll see from my screenshot below, I’m just buying $1.00 worth of Tesla (fractional share) for the sake of this tutorial, but there are no additional fees associated with my purchase.

The reason why there are no commission fees and no currency conversion fees for this order is that for one, Wealthsimple Trade has commission-free trades, but also because I have a Wealthsimple Trade Plus, which gives me a USD account, and therefore, there are no foreign exchange fees associated with my trade as I’m trading at market order in US dollars.

For a more in-depth breakdown of how Wealthsimple calculates this currency conversion fee, check out my article Wealthsimple Trade Fees | Simple Breakdown With Examples

Step #5 – Click Done

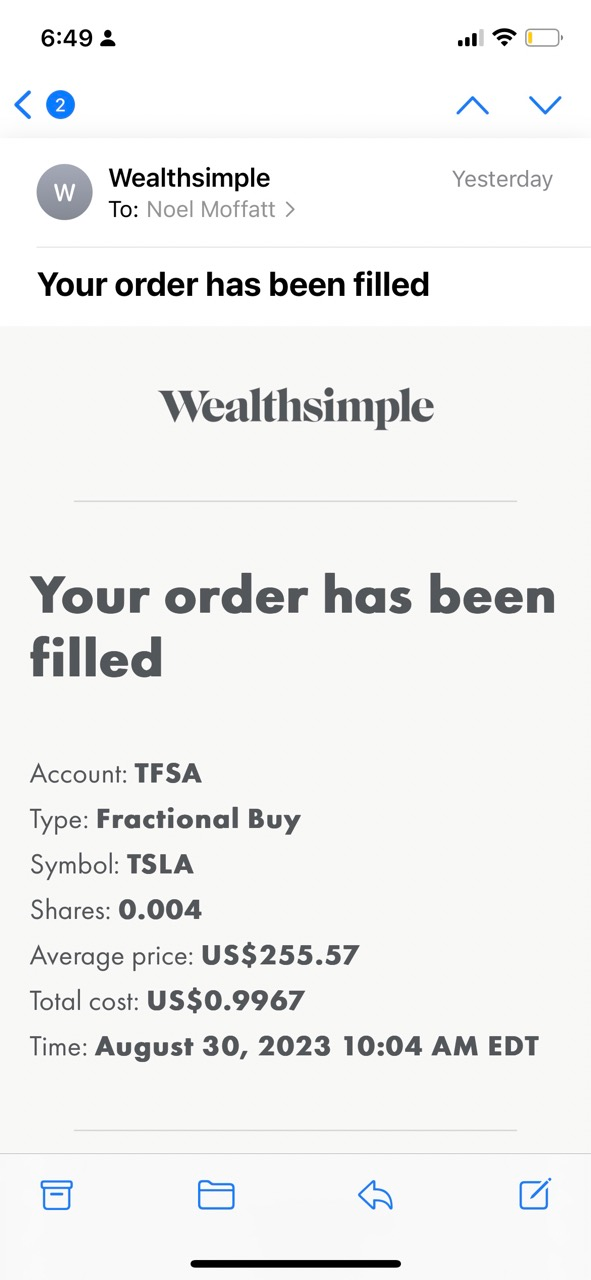

Finally, once you’ve confirmed your order and it is successfully filled, you’ll get a confirmation email that looks like this:

And there you have it: whatever stock you chose to buy that trading day, whether it was Tesla or something else, you now own a piece of the American market – congrats!

How Do I Convert CAD to USD on Wealthsimple?

If you’re someone like me who doesn’t mind paying the $10 a month to avoid paying a currency conversion fee every time you invest in the American stock market (like the New York Stock Exchange [3] ), then I’d highly recommend the Wealthsimple Plus plan.

But even with this plan, while you don’t have to pay a currency conversion fee every time you trade a stock or ETF, investors do have to pay a small fee when converting their CAD cash to their USD accounts.

Related Article: Can You Buy Index Funds on Wealthsimple? [And How To Do It]

The process of doing this is super straightforward, assuming you already have CAD funds in your account, here is a quick guide on how to do this.

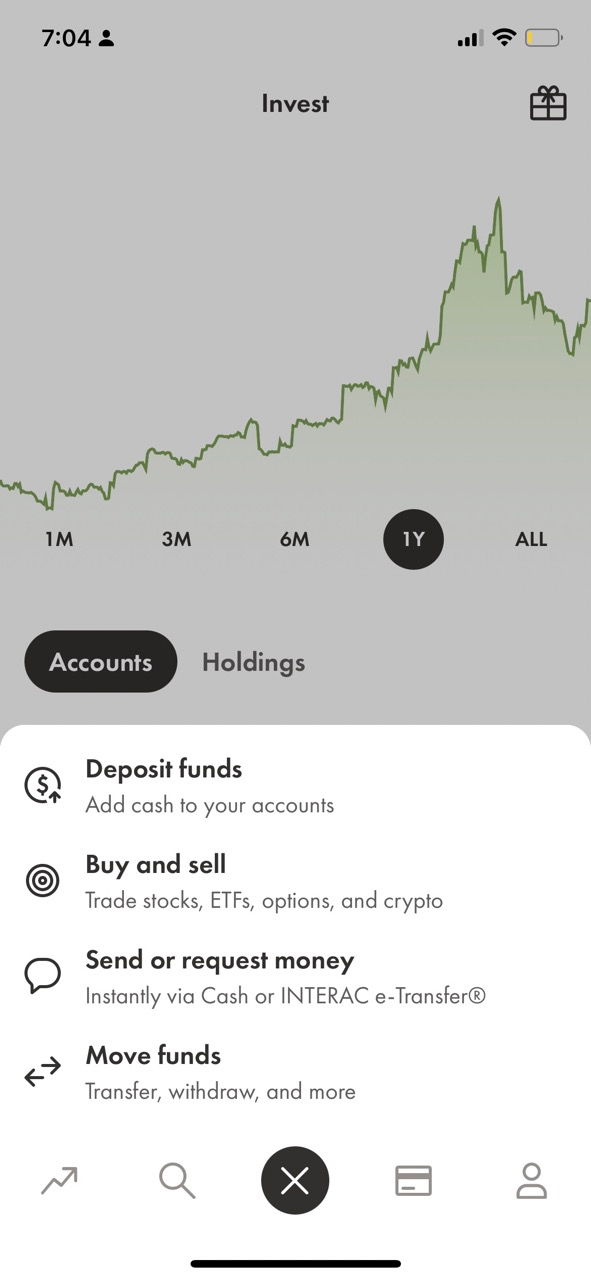

Step 1 – Go to the Wealthsimple Homepage

Once you’re on the homepage, click the middle black $ button in the bottom navigation.

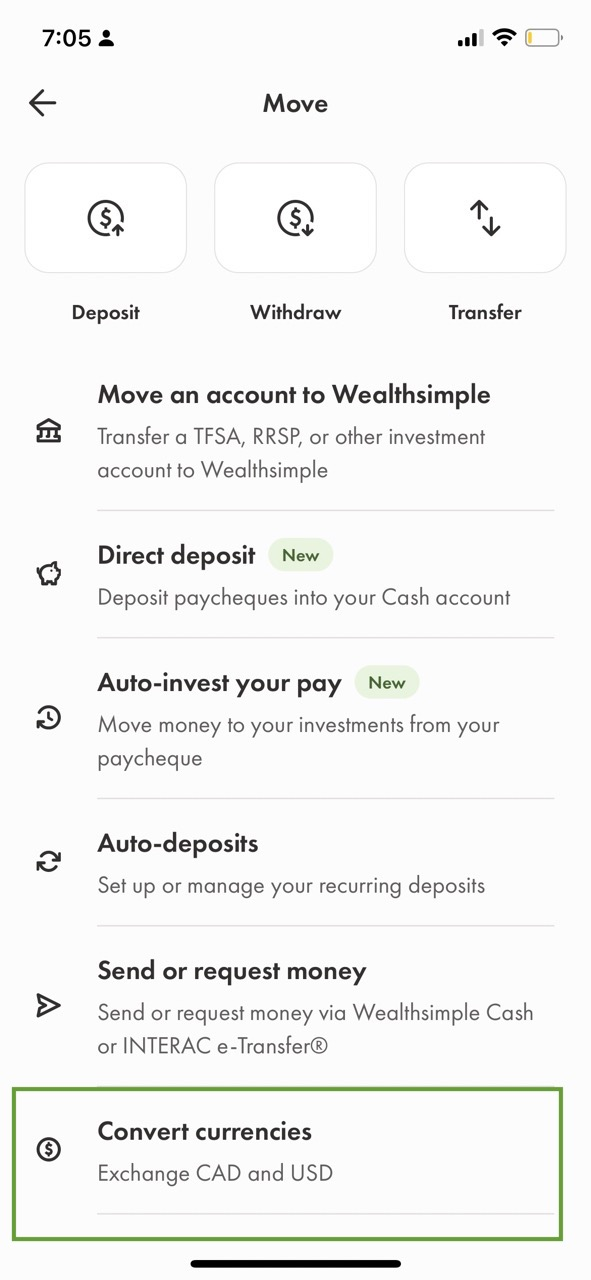

Step 2 – Select Convert Currencies

Now select “Convert Currencies”

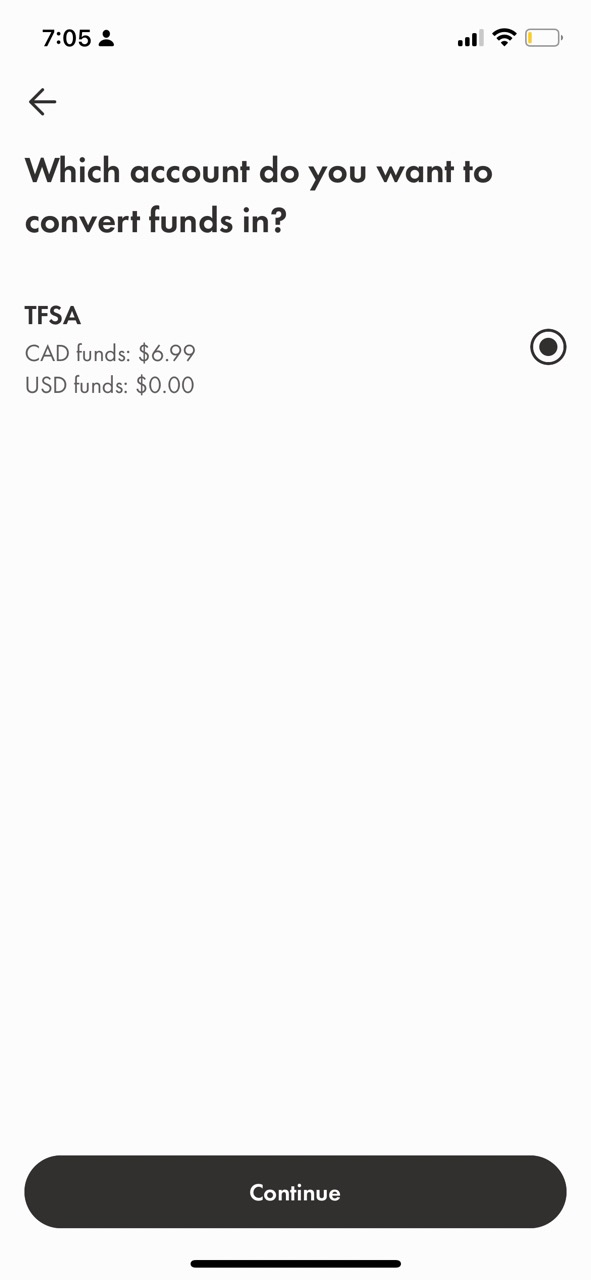

Step 3 – Select the Account You Want to Convert Your Funds In

Now select in which account you want to convert your funds in – this could be a TFSA, RRSP, personal account or whatever account you have opened with the Wealthsimple app.

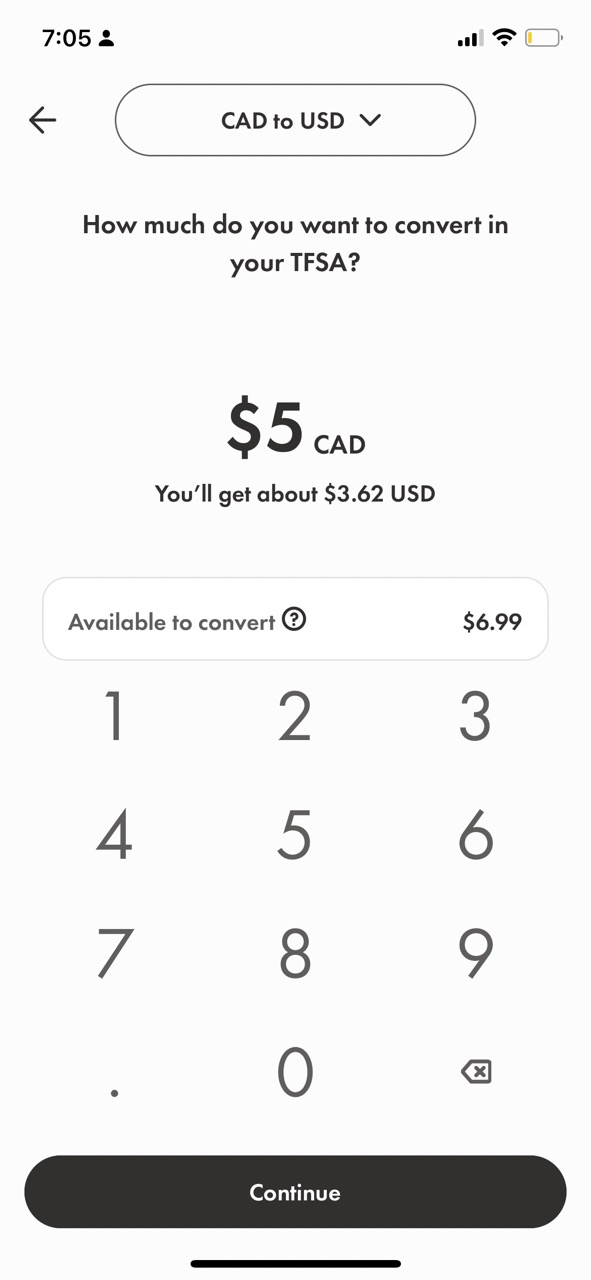

Step 4 – Input The Amount You Want to Convert and Confirm Order

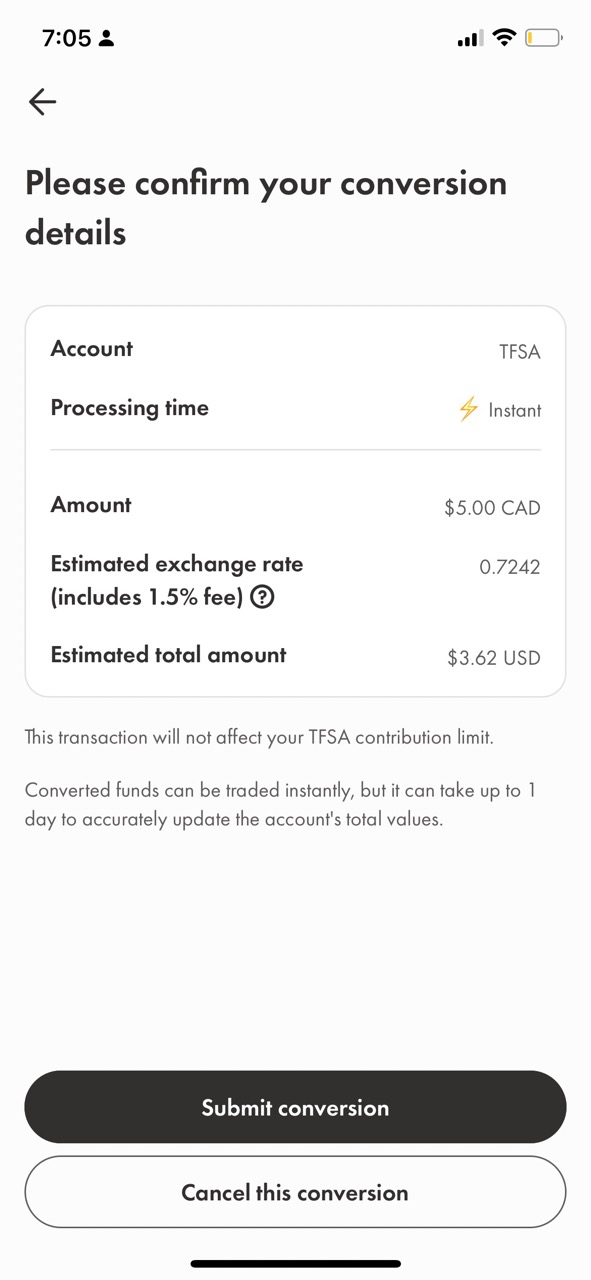

Finally, you’ll input the amount of money you want to convert and click continue. You’ll then see a confirmation screen that will break down your costs for converting your funds (1.5%).

Once you click Submit Conversion, your conversion will be instantly complete, and you’ll see funds in your USD account.

FAQs about Investing in the US Stock Market with Wealthsimple

Can Wealthsimple be Used in the US?

Wealthsimple isn’t authorized to manage accounts for individuals who are located outside Canada. This includes Canadians who are currently living overseas.

Does Wealthsimple have a USD account?

Yes, Wealthsimple Trade offers a USD account, known as the Plus subscription. To access it, log into the Wealthsimple app on your smartphone, click on the Profile icon situated at the screen’s base, select the Status and Subscriptions option, and then click on USD accounts.

What is the Wealthsimple Conversion Fee for USD to CAD?

The conversion fee charged by Wealthsimple Investments Inc. (WSII) is 1.5% for transactions between USD and CAD (and the reverse) when trading US-based stocks from your CAD Account or when transitioning cash to and from your USD account for Plus subscribers. For further clarity, this fee is adjusted to the WSII Corporate Exchange Rate.

Can I Invest USD in TFSA?

While you can deposit foreign currencies like USD into a TFSA, your provider will convert these funds to Canadian dollars (based on the prevailing exchange rate at the transaction’s time) before reporting the contribution. Ensure that the converted amount, denominated in Canadian dollars, doesn’t exceed your available TFSA contribution limit.

![Wealthsimple Tax Review for 2024 [Previously SimpleTax]](https://noelmoffatt.com/wp-content/uploads/2023/04/Wealthsimple-Tax-Review-1-768x384.jpg)