Is The Wealthsimple Cash Card Free? (Quickly Answered)

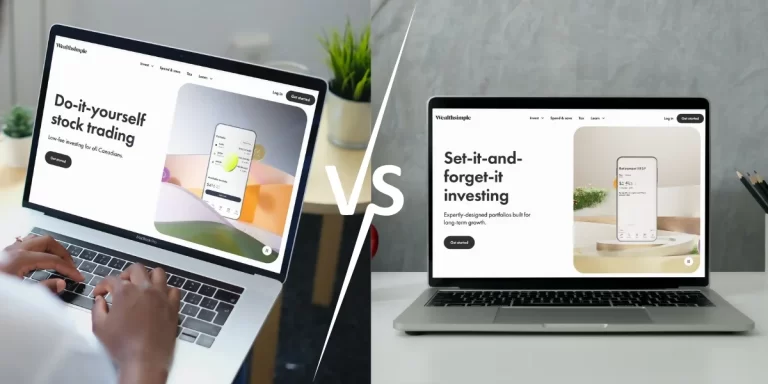

Wealthsimple Cash Card is a prepaid Mastercard that allows users to spend funds directly from their Cash account. It’s a popular financial product in Canada due to its simplicity and the benefits it offers.

One of the most common questions that users have about the Wealthsimple Cash Card is whether or not it is free to use.

The answer is yes. With the Wealthsimple Cash Card, there are no account management or transaction fees. Wealthsimple has designed this product to be simple and without any hidden administration fees. It wants to offer a variety of low-cost (or free) financial products for folks. This means that users can enjoy the benefits of the card without ever worrying about any additional costs.

In this article, we’ll explore the Wealthsimple Cash Card in detail, including its features, benefits, and even some of its drawbacks. We will also answer some frequently asked questions about the card and provide key takeaways to help readers understand whether the Wealthsimple Cash Card is the right financial product for them.

Having used Wealthsimple Cash for over two years, and written in-depth reviews on it, I’ve garnered a really solid understanding of its benefits, features and drawbacks. Interestingly enough, in 2021 Wealthsimple recognized me as one of their top 500 active clients.

Key Takeaways

1. Free to Use

The Wealthsimple Cash Card is free to use, with no account, management, or transaction fees.2. 1% Cashback

The card offers 1% cashback on all eligible purchases, with the option to earn stock or crypto back instead.3. Convenient

The Wealthsimple Cash Card is a simple and convenient financial product that is worth considering for those looking for a low-cost or free prepaid card.

Is the Wealthsimple Mastercard Free?

Wealthsimple Cash Card is a prepaid [1] Mastercard that allows users to spend funds directly from their spending (Cash) account. The card can be used anywhere that accepts Mastercard.

One of the most significant advantages of the Wealthsimple Cash Card is that it has no monthly or annual fees, making it a great option for those looking for a no-fee cash back “credit card”. This means that users can use the card without worrying about any hidden charge – bottom line.

While there are no fees associated with the card, it’s important to note that there may be fees associated with your Wealthsimple Cash account, such as foreign transaction fees [2] or ATM fees. However, these fees are clearly outlined in the account agreement and can be avoided by using the card at merchants that accept Mastercard or by using one of the thousands of fee-free ATMs across Canada.

Important Note: While the Wealthsimple Cash account is free, there are fees associated with Wealthsimple’s managed and trading accounts.

In addition to being fee-free, the Wealthsimple Cash Card also offers users the opportunity to earn 1% cash back on all purchases when they pay using their card. This makes it a great option for those who want to earn rewards while spending money – we’ll talk more about this shortly.

To request a Wealthsimple Cash Card issued by Mastercard, users can follow the instructions provided on the Help Centre’s Request a Cash card issued by Mastercard page. It is important to note that users who already have a Wealthsimple Cash card issued by VISA should also refer to the Help Centre’s article for existing clients instead (Wealthsimple’s prepaid card issuer use to be VISA, but it’s now Mastercard)

What Are The Benefits of Wealthsimple Mastercard?

The Wealthsimple Cash Card is a prepaid Mastercard that offers several benefits to its users.

Here are some of the advantages of using the Wealthsimple Mastercard:

1. 1% Cash Back on All Purchases

Another benefit of using the Wealthsimple Cash Card is that it offers 1% cash back on all purchases [3].

This means that users can earn money back on their everyday expenses, such as groceries, gas, and entertainment and the cashback is automatically added to the user’s Wealthsimple Cash account, which can then be used to invest, save, or spend.

2. No Annual Fees

As discussed above, one of the most significant benefits of the Wealthsimple Cash Card is that it has no annual fees. This means that users can enjoy the perks of having a Mastercard without having to pay any fees. This is especially beneficial for users who are looking for a cost-effective way to manage their finances (like me lol).

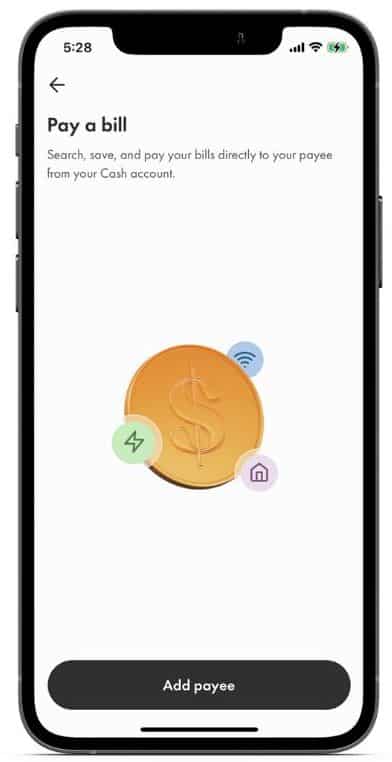

3. Free Money Transfer App

The Wealthsimple Cash Card also comes with a free money transfer app that allows users to send and receive money instantly. The app is available for both iOS and Android devices and is easy to use. Users can transfer money to other Wealthsimple Cash users or to external bank accounts.

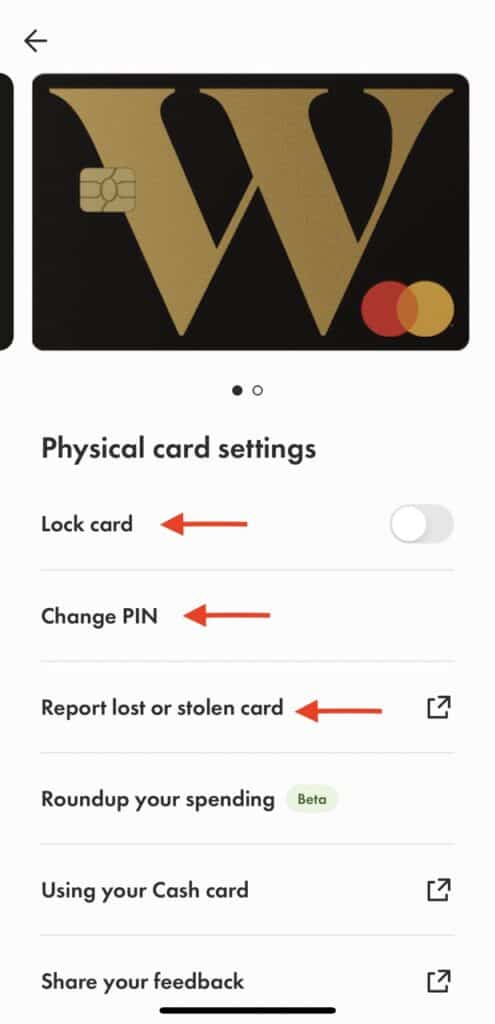

4. Access to Virtual and Physical Card

The Wealthsimple Cash Card offers both a virtual and physical card, which makes it easy for users to make purchases online and in-store and maintain the security of the card. The virtual card can be accessed through the Wealthsimple Cash app, while the physical card can be used at any merchant that accepts Mastercard.

My Experience with Wealthsimple Cash

I’ve been a loyal user of Wealthsimple Cash for several years, primarily leaning on it for everyday expenses like food, gas, entertainment and all the other useless stuff I buy.

Its spending feature stands out as my most used feature by far. Although I’ve yet to explore options like direct deposit, auto-invest, and round-up spending, but I’d imagine Ill be giving those a try down the line.

I do occasionally dive into its peer-to-peer lending capability. However, given that Wealthsimple Cash isn’t as widely adopted yet, I often find myself relying on the e-transfer function for money transactions.

With that said though, the peer-to-peer function, when applicable, operates really well (Similar to Venmo in the States)

A recent shift has seen Wealthsimple Cash’s standalone app being integrated into the broader Invest, Trade, and Crypto app. I will admit that this umbrella approach sometimes introduces minor glitches. It’s not a major concern, but definitely something I’ve noticed in recent months.

Noel’s Take on Wealthsimple Cash

I give Wealthsimple Cash a solid 4.5/5 rating. It’s super easy to use, gives cash back on all spending, always innovates and releases cool features, and its potential to curb overspending makes it a worthy tool in my financial toolbox.

Bottom Line

The Wealthsimple Cash Card is a prepaid Mastercard that is completely free of charge, with no annual fee or minimum account balance. You can easily apply for the card in-app if you have a Wealthsimple Cash account and start earning 1% cash back on all purchases.

Overall, the Wealthsimple Cash Card is a great option for those looking for a free alternative to traditional banking and credit cards. With its easy-to-use app and 1% cash back on all purchases, it’s a great way to manage your money and earn rewards at the same time.

FAQs about the Wealthsimple Cash Card

Is Wealthsimple Mastercard a credit card?

No, the Wealthsimple Cash Card is not a credit card. It is a prepaid Mastercard that allows you to spend funds directly from your spending (Cash) account. The card uses the Mastercard payments system, so you can use it anywhere that accepts Mastercard.

Does Wealthsimple Mastercard affect credit score?

No, the Wealthsimple Cash Card does not affect your credit score because it is not a credit card. You are not borrowing money when you use the card, but rather spending your own money that you have loaded onto the card. Therefore, there is no credit check required to get the card and no credit score impact when you use it.

![Can You Buy Index Funds on Wealthsimple? [And How To Do It]](https://noelmoffatt.com/wp-content/uploads/2023/08/Can-You-Buy-Index-Funds-on-Wealthsimple.jpg)