Wealthsimple Day Trading: The Right Platform for a Day Trader?

As a Canadian investor, you may be wondering about the possibility of day trading with Wealthsimple.

So let’s first clear the air on if this is even possible, and then we’ll dive into if it’s a good idea or not.

While Wealthsimple doesn’t typically advocate for day trading on its Wealthsimple Trade platform, it is indeed an option that is available to investors.

As someone who has used Wealthsimple Trade for several years, my recommendation leans more towards using the platform for long-term investments rather than day trading.

But that’s just me – each to their own.

Just know that you can day trade on Wealthsimple Trade if you wish, but the platform is not designed for this type of trading, nor does Wealthsimple recommend it [1].

With that said, if Wealthsimple day trading is something you’re determined to go ahead with it anyway, I’d urge you to first at least consider all the information related to things like fees, pros and cons before jumping right in.

So let’s get into it.

Can You Day Trade With Wealthsimple?

While you can technically day trade with Wealthsimple, the platform discourages this practice.

Additionally, Wealthsimple, as a member of the Investment Industry Regulatory Organization of Canada (IIROC) [2], has the authority to monitor trading activities and even block inappropriate transactions.

So even though you can immediately avail of your assets after you buy or sell them, it doesn’t necessarily make it a suitable platform for day traders. And because of this, Wealthsimple encourages consultation with a tax specialist before any sort of day trading activity on their platform.

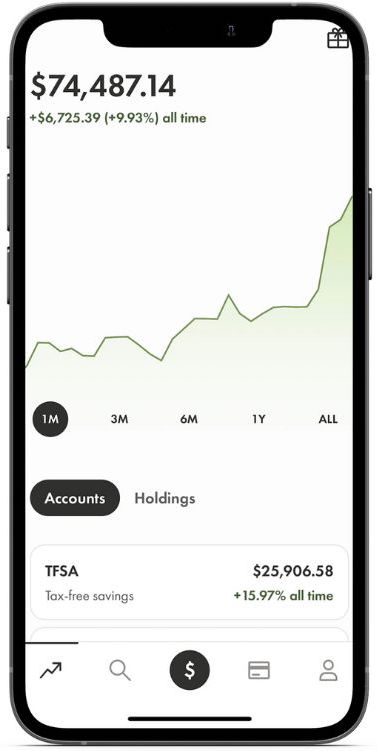

In my own personal experience, the platform primarily caters to more medium and long-term investors.

I’ve been a Wealthsimple Invest user since 2018 and a Wealthsimple Trade user since 2019 (wealthsimple invest compared to trade), and I really don’t think their platform is well-suited for day trading. To be completely honest, for those insistent on day trading, a platform like Questrade might be a better fit.

How Much Does Wealthsimple Charge For Day Trading?

If you do decide to day trade on Wealthsimple and you want to buy and sell American stocks (Apple, Telsa, etc.), just know you’ll be subject to a 1.5% currency conversion fee if you’re not a USD account subscriber, which is a Wealthsimple Trade Plus account – you can learn more Plus in my Trade review here.

It’s important to note, though, that this currency conversion fee only applies when you trade American stocks, AND it applies to any sort of trading and not only day trading. – But nonetheless, if you do decide to day trade American stocks or ETFs, you’ll be hit with that 1.5% conversion fee on both the purchase and sale of your assets.

Here’s how to calculate the fee:

- Determine the total price of your investment in USD.

- Find the current USD to CDN exchange rate.

- Multiply the current exchange rate by 1.5%.

- Multiply the resulting number by the total price of your investment in USD.

- Multiply the current USD to CDN exchange rate by your total investment price in USD.

- Subtract the figure from Step 5 from the number obtained in Step 4.

- The final number is the conversion fee that will be included in your total order cost.

But to reiterate, Wealthsimple Trade Plus, a premium account, which costs $10 a month, does eliminate this 1.5% conversion fee when dealing with US stocks.

Below is a good video I found on Youtube on whether or not Wealthsimple Plus is actually worth it.

And here’s one more added layer you might not have thought about – in Canada, profits earned from day trading are categorized as business income rather than capital gains.

What does this really mean?

Essentially, since day trading profits fall under the business income umbrella, they attract a 100% tax rate rather than the comparatively lenient 50% tax rate associated with capital gains tax.

So not only are you subject to Wealthsimple fees, but the potential tax implications for all account types, including RRSPs and TFSAs, should be something you’re aware of too.

Is Wealthsimple Good For Day Trading? The Pros and Cons

To make an informed decision, consider the following pros and cons:

| Pros | Cons |

|---|---|

| No Fees When Trading Canadian Stocks | Currency Conversion Fee |

| Mobile Trading App | Potential to Block Transactions |

| Fractional Share Trading | Risky Nature of Day Trading |

Pros

Pro #1 – No Trading Fees on Canadian Stocks

Wealthsimple Trade doesn’t have any commission fees when trading Canadian equities.

Pro #2 – Mobile Trading App

With its mobile trading app, Wealthsimple offers easy, on-the-go trading.

Pro #3 – Fractional Share Trading

Wealthsimple enables fractional share trading, which means you can purchase parts of a share rather than a whole one. This can make investing and trading your favourite stocks much more affordable.

Cons

Con #1 – Currency Conversion Fee

If you’re not a Trade Plus subscriber, a 1.5% currency conversion fee applies when dealing with US stocks.

Con#2 – Potential to Block Transactions

Wealthsimple reserves the right to block what it deems as inappropriate trading.

Con#3 – Risky Nature of Day Trading

Regardless of the platform, day trading is risky and can potentially result in significant financial loss.

Noel’s Take on Wealthsimple Trade

Due to its low costs, diverse investment options and overall ease of use, I think Wealthsimple Trade is Canada’s best self-directed online brokerage platform, and I would give it a score of 4.5/5.

FAQs about Day Trading and Wealthsimple

Day trading in Canada is completely legal. But it’s crucial that your online brokerage is overseen by the IIROC (Investment Industry Regulatory Organization of Canada), which is an organization put in place to regulate investment dealers to safeguard its investors.

The CRA does not allow investors to buy and sell securities within their TFSA frequently. Any income generated from day trading within a TFSA will be considered business income and, therefore will be taxed as such.

No. While Wealthsimple offers easy-to-use platforms and low fees, it’s not ideal for day trading due to its lack of advanced charting tools and high currency conversion fees.

![Can You Short on Wealthsimple? [And How Shorting Works]](https://noelmoffatt.com/wp-content/uploads/2023/07/can-you-short-on-Wealthsimple-1-768x327.jpg)

![Can You Buy Index Funds on Wealthsimple? [And How To Do It]](https://noelmoffatt.com/wp-content/uploads/2023/08/Can-You-Buy-Index-Funds-on-Wealthsimple.jpg)

![Wealthsimple Pros And Cons for 2024 [My Honest Take]](https://noelmoffatt.com/wp-content/uploads/2023/09/wealthsimple-pros-and-cons-768x538.jpg)

![Wealthsimple Tax Review for 2024 [Previously SimpleTax]](https://noelmoffatt.com/wp-content/uploads/2023/04/Wealthsimple-Tax-Review-1-768x384.jpg)