Wealthsimple Pros And Cons for 2024 [My Honest Take]

Quick Overview

| Platform | Pros | Cons |

|---|---|---|

| Wealthsimple Invest | – Built for beginner investors – Limited fees – Automated investing feature – All-in-one mobile app – Socially Responsible Investing | – Limited control over investments – Some competitors have lower management fees – No 24/7 customer support – No advanced analysis tool or charts |

| Wealthsimple Trade | – No Commission Fees – Fractional Shares Available – $1 Minimum Deposit | – No Margin Accounts – Currency Conversion Fees – Deposits Can Take Up to 3 Days to Process |

| Wealthsimple Crypto | – Limited Platform Fees – $0 Minimum Balance – Access to Crypto Wallets | – Wallet Transfers Not Supported by All Coins – Only Supported In Canada – Funding Restricted to CAD |

| Wealthsimple Tax | – Pay-What-You-Want Pricing – NETFILE Certified Tax Software – Fast Refunds – Tax Loss Harvesting | – No Expert Review Option – Limited Customer Support – Requires Basic Tax Literacy |

| Wealthsimple Cash | – 1% Cash Back on Spending – Instant Deposits – Round-up Spending Feature | – 2.5% Fee for Instant Withdrawals – Daily Spending and ATM Limits – Not All Merchants Accept Prepaid Cards |

Wealthsimple, a Canadian financial tech gem, has made waves in the financial sector with its diverse product lineup.

Over the years, they’ve rolled out a variety of tools: from the flagship robo advisor, Wealthsimple Invest, to self-directed trading on the Wealthsimple Trade app, crypto trading with Wealthsimple Crypto, and even an online tax-filing service and a pre-paid cash card.

Now if you’re a little confused about which of these tools offer what, and the pros and cons associated with each platform, well then you’re in luck.

This post is going to break down the pros and cons of the 5 main products that Wealthsimple offers. if you want a more full in-depth review of each specific product, you can check out reviews.

- Robo advisor (Wealthsimple Invest – Read Review Here)

- Self-directed investment platform (Wealtshimple Trade – Read Review Here)

- Crypto platform (Wealthsimple Crypto – Read Review Here)

- Online tax-filing software (Wealthsimple Tax – Read Review Here)

- Pre-paid cash card (Wealtshimple Cash – Read Review Here)

I’ve been using Wealthsimple since 2018, and I still use all 5 of these products to this day. So sit tight and allow me to give you my honest pros and cons list for each of the 5 products.

Wealthsimple Invest

Pros

Cons

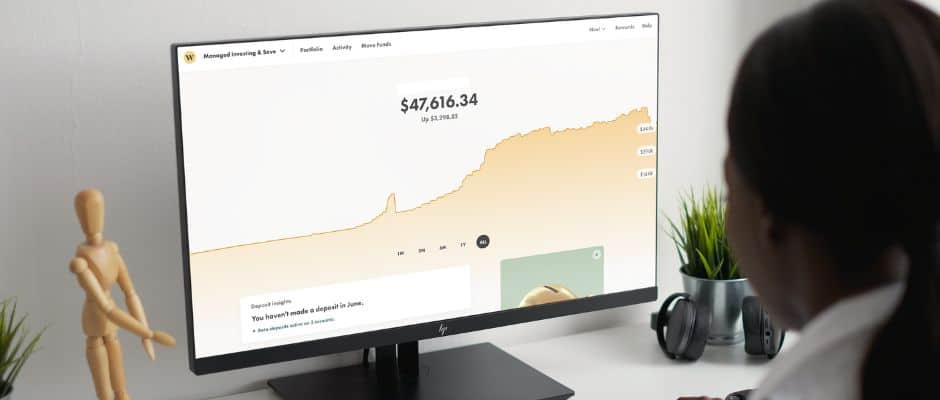

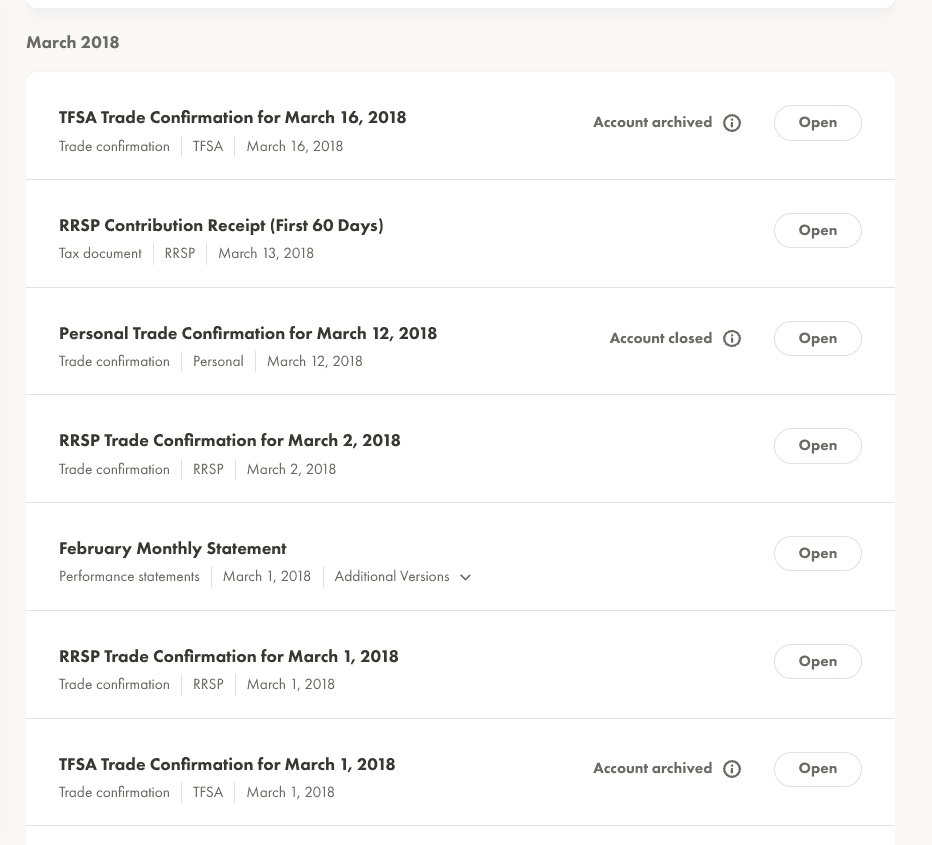

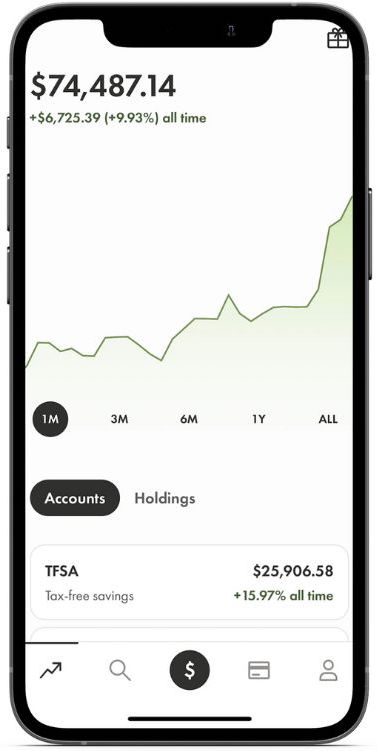

Over the last 5-6 years, I’ve tested and experimented with a lot of different fintech platforms. And with all the products I reviewed, Wealthsimple Invest is the one I can speak on with the most confidence when it comes to personal finance.

As mentioned above, not only did I sign up for a Wealthsimple Invest account back in 2018, but I continue to have my money invested with them to this day.

So when I say I’ve had a fantastic experience with Wealthsimple Invest so far since 2018, I truly mean it.

The thing I like the most about the platform is its user-friendliness for first-time investors, its competitive management fee structure, and lastly, Wealthsimple’s transparency as a company – you know exactly what you getting.

When you speak with a member of their support team, you don’t feel like you are being sold to or viewed as an upsell opportunity. They just try to help you solve your issues as fast as possible, and from my first-hand experience, they are super helpful and always pleasant.

Finally, as someone who loves things to be simple, Wealthsimple is great because it really does make everything so easy – from signing up to connecting your bank account to investing, it really is SO much easier and quicker than a TFSA with some of the other large banks.

Noel’s Take on Wealthsimple Invest

Due to its low costs, the wide array of investment choices, and an interface that beginners would find easy to navigate, I confidently award Wealthsimple Invest a commendable score of 4.5 out of 5.

Wealthsimple Trade

Pros

Cons

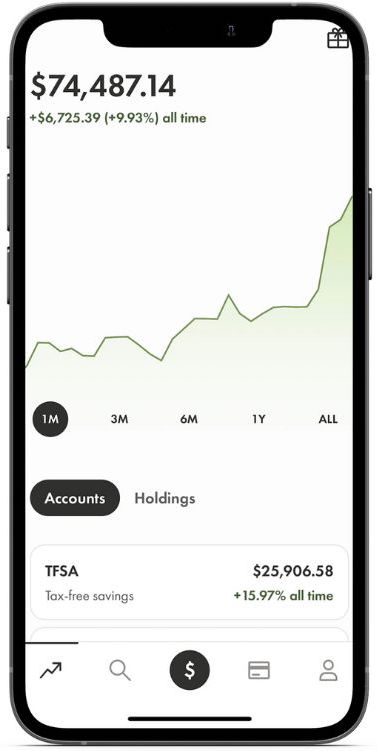

Wealthsimple Trade is the go-to platform within Wealthsimple’s suite for those interested in self-directed investments. This means if you’re keen on directly buying or selling specific stocks and ETFs [1] , like Tesla or Apple, this is where you’d set up an account.

The distinct edge of Wealthsimple Trade is the autonomy it offers investors, allowing them complete control over their trades. In contrast, Wealthsimple Invest streamlines the process: investors simply define their own risk tolerance and appetite, and Wealthsimple handles the subsequent investment steps.

Noel’s Take on Wealthsimple Trade

Due to its low costs, diverse investment options and overall ease of use, I think Wealthsimple Trade is Canada’s best self-directed online brokerage platform, and I would give it a score of 4.5/5.

Wealthsimple Crypto

Pros

Cons

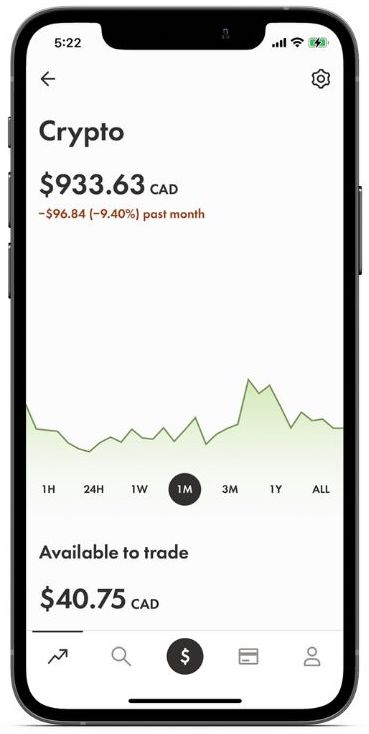

Wealthsimple Crypto is fast becoming a top choice for Canadians exploring the cryptocurrency landscape. One of its key advantages is the limited account fees, ensuring that users don’t face hefty charges for their trades. Furthermore, with a $0 minimum investment requirement, it’s accessible to everyone, regardless of the investment amount.

The platform grants users access to crypto wallets and, importantly, operates under the regulation of the Canadian government. For those keen on maximizing their investments, they’ll be pleased to know that staking rewards are offered. Additionally, a diverse range of over 50 coins is available for trading, ensuring a comprehensive crypto experience.

However, every platform has its areas for improvement. Wealthsimple Crypto does have its limitations. Not all coins support wallet transfers [2] , which can be a drawback for some investors. Moreover, its services are exclusive to Canada and are restricted to CAD funding. Also, those seeking round-the-clock assistance might be slightly disappointed, as 24/7 customer support isn’t available.

All in all, while the platform offers numerous benefits, potential users should be mindful of its limitations before diving in.

Noel’s Take on Wealthsimple Crypto

Wealthsimple Crypto scores a solid 4.5/5 from me – It’s dead simple to use, and they’re constantly improving with new features. Depending on who you ask, their fees can be seen as high, but I feel safe using a regulated Canadian exchange which is why it’s my go-to for buying and managing my crypto.

Wealthsimple Tax

Pros

Cons

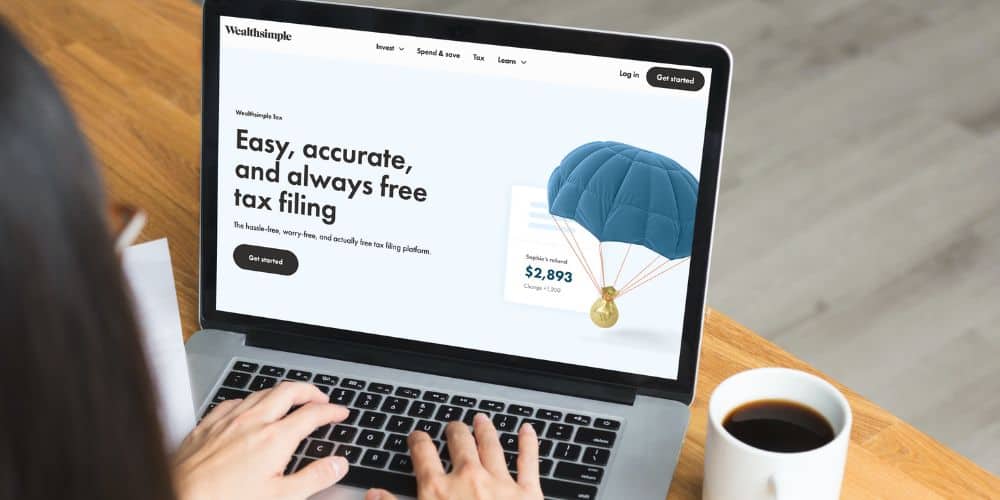

For Canadians on the hunt for an uncomplicated and economical way to file taxes online, Wealthsimple Tax has emerged as a revolutionary solution.

Drawing from my own interactions with it, the platform stands out for its intuitive ease of use.

Harnessing cutting-edge algorithms, Wealthsimple Tax ensures you maximize on your tax returns by identifying every potential credit and deduction. The aim? Make sure you don’t overlook any financial opportunities.

What particularly resonates with me is Wealthsimple Tax’s capability to detect errors. Before you take the nerve-wracking step of pressing the ‘submit’ button, the platform reviews your input for inconsistencies or mistakes, effectively allaying concerns about potential audits.

Moreover, for those immersed in the crypto realm, there’s an added perk. Should you have a Wealthsimple Crypto wallet, Wealthsimple Tax can seamlessly sync with it, fetching the necessary data. This is a boon given the intricate tax nuances associated with cryptocurrencies.

However, it’s worth noting that Wealthsimple Tax might not align with everyone’s preferences. If you lean more towards traditional methods, valuing in-person discussions with tax experts, or have a particularly intricate tax scenario, you might consider casting a wider net for alternatives.

But for those valuing precision, affordability, and simplicity in their tax-filing journey, Wealthsimple Tax is undoubtedly worth considering.

Noel’s Take on Wealthsimple Tax

Wealthsimple Tax gets a thumbs-up from me with a 4.5/5 rating. It’s super user-friendly, cost-effective, and takes the headache out of tax season. This tool is a winner if your tax situation isn’t too complex. Plus, the crypto integration is a sweet bonus.

Wealthsimple Cash

Pros

Cons

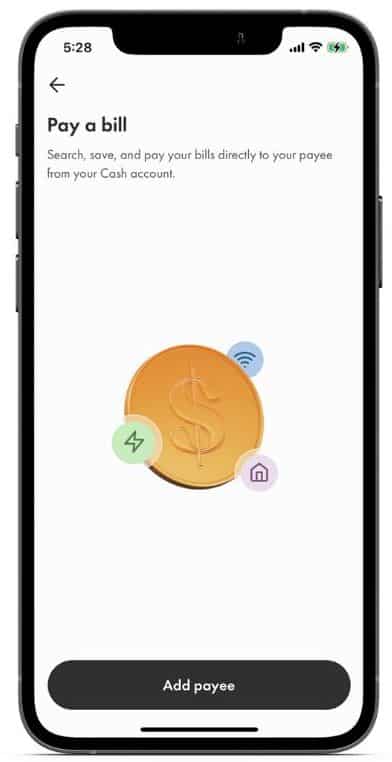

Wealthsimple Cash has become an invaluable tool for those in search of an efficient method to manage their routine expenditures. Personally, I can vouch for the excellence of this platform.

Leveraging the best of modern banking technologies, Wealthsimple Cash offers users the ability to regulate their day-to-day spending via a prepaid credit card, which also rewards them with cashback.

Pretty appealing, right?

What I personally find endearing is its capability to prevent overspending and limit credit card debts. Using a prepaid card is similar to using a debit card because you have to load money onto the card prior to making a purchase [3] . The difference here is that you earn attractive rewards, a feature absent in conventional debit cards.

Additionally, if you’re someone who uses Wealthsimple’s other offerings like Invest, Trade, or Crypto, incorporating Wealthsimple Cash can seamlessly unify your financial dealings.

That said, Wealthsimple Cash might not cater to every individual’s requirements.

Those looking for premium rewards, akin to AMEX, might find themselves wanting more. And, if you value in-person interactions with a bank representative over virtual chats or emails, this platform might fall short of your expectations.

Another point to bear in mind is that while the Wealthsimple Cash card doesn’t negatively affect your credit rating, it doesn’t elevate it either.

To be completely transparent, post the integration of Wealthsimple Cash’s app with the Invest, Trade, and Crypto app in 2022, I’ve observed some glitches. But when weighed against the convenience of an all-in-one financial ecosystem, these glitches seem relatively trivial.

All in all, I’d award Wealthsimple Cash a commendable 4.5/5.

Minor issues aside, it’s an app I frequent daily, and I have every intention of continuing its use.

Noel’s Take on Wealthsimple Cash

I give Wealthsimple Cash a solid 4.5/5 rating. It’s super easy to use, gives cash back on all spending, always innovates and releases cool features, and its potential to curb overspending makes it a worthy tool in my financial toolbox.

FAQs About Wealthsimple

Is Wealthsimple Trustworthy?

While Wealthsimple isn’t a bank, it operates under strict regulations set by oversight bodies such as the Investment Industry Regulatory Organization of Canada (IIROC). Additionally, Wealthsimple is covered by the Canadian Investor Protection Fund, further enhancing the security of client funds.

What is the Investment Industry Regulatory Organization (IRROC)?

IRROC is a self-regulatory organization in Canada that oversees all investment dealers and trading activity on debt and equity marketplaces in the country.

What Are The Negatives Of Wealthsimple?

The biggest downside associated with Wealthsimple from a trading perspective is that it doesn’t offer extensive market news, advanced functionalities, customizable filters, research capabilities, and other enhanced features. My article here discusses 15 more downsides of Wealthsimple.

Can You Withdraw Funds from the Wealthsimple Trade App into Your Bank Account?

Yes, you can withdraw funds from Wealthsimple Trade into your linked bank account. Once you sell your investments and the trade is settled, the funds become available for withdrawal. Ensure that you have linked your bank account to your Wealthsimple Trade account, then follow the app’s withdrawal procedures to transfer your funds. Withdrawal times may vary based on your bank’s processing times.

Quick Note: For more pros and cons from actual Wealthsimple users, check out this Reddit thread.

![Can You Short on Wealthsimple? [And How Shorting Works]](https://noelmoffatt.com/wp-content/uploads/2023/07/can-you-short-on-Wealthsimple-1-768x327.jpg)

![How To Buy Dividend Stocks On Wealthsimple [2024 Tutorial]](https://noelmoffatt.com/wp-content/uploads/2023/08/How-tp-Buy-Dividend-Stocks-on-Wealthsimple-768x538.jpg)