15 Downsides to Wealthsimple Canadians Should Know (2024)

I’m an avid user and a big fan of Wealthsimple products – let’s get that out of the way first.

But with transparency in mind, I want to shed light on some downsides associated with some of the Wealthsimple accounts. No platform is perfect, so it’s essential to be well-informed before making any financial decisions.

As you may or may not know, Wealtshimple has 5 main products:

- Robo advisor (Wealthsimple Invest – Read my Review Here)

- Do-It-Yourself Investment Platform (Wealtshimple Trade – Read my Review Here)

- Crypto Platform (Wealthsimple Crypto – Read my Review Here)

- Online Tax Software (Wealthsimple Tax – Read my Review Here)

- Pre-Paid Mastercard (Wealtshimple Cash – Read my Review Here)

So, in this article, I’m going to touch on some of the downsides associated with these products as it stands in 2023.

Let’s get into it.

What Are the Downsides To Wealthsimple?

1. No Margin Account Offering on a Wealthsimple Trade Account

- Product: Wealthsimple Trade

Unlike its competitors, Questrade being one of them, Wealthsimple Trade actually doesn’t offer margin accounts to its investors.

If you’re a new investor, you might not even know what a margin account is, which isn’t necessarily a bad thing, as there is a ton of risk associated with buying on margin.

Buying on margin is when investors borrow money from their brokerage to invest, which gives investors more buying power when trading stocks and ETFs [1]. While this can be great in theory, if your investments don’t pan out the way you thought, well, now you are in debt.

So if you’re a beginner investor, I wouldn’t factor this con into my decision-making process too much, as, again, it’s not something I’d recommend new investors take advantage of to begin with. However, if you are used to trading on margin and are more of a savvy, experienced investor, well, then you’ll definitely want to keep this in mind before opening up an account.

2. Currency Conversion Fees

- Product: Wealthsimple Trade

Although your Wealthsimple Trade (Wealthsimple’s DIY online brokerage) account won’t charge trading commissions or commission fees when purchasing stock, they do charge what’s called a currency conversion fee (1.5% ) when buying and selling US stocks and ETFs. These fees can also be referred to as foreign exchange fees.

I wouldn’t say this is a hidden fee as it’s not something they try to hide, but it’s something that some investors aren’t aware of because when they read they could make commission-free trades, they automatically assume it comes at no cost, which isn’t necessarily the case.

Wealthsimple Trade’s 1.5% currency conversion fee is charged every time you buy and sell stocks and ETFs (exchange-traded funds) from the US.

With that said, in early 2022, Wealthsimple Trade came out with a premium account called Wealthsimple Trade Plus. This account comes with US dollars, so even when you’re not buying Canadian stocks, you actually still won’t have to pay the 1.5 currency conversion fee.

3. Not Able To Short Stocks

- Product: Wealthsimple Trade

For those looking to short-sell a particular stock or index, Wealthsimple Trade currently does not offer that option. In fact, after reaching out to Wealthsimple directly, their Customer Support affirmed, “Short selling is not supported on Wealthsimple.”

While Wealthsimple allows for the buying and selling of stocks, ETFs (exchange-traded funds), cryptocurrencies, and as of early 2023, options trading, this is not the same as options trading as I talk about in my article here.

4. No RESP Offering

- Product: Wealthsimple Trade

Unlike some of Wealthsimple’s competitors, the Wealthsimple Trade platform does not support investors opening RESPs. While Wealthsimple Invest, Wealthsimple’s managed investing platform, supports RESPs, Wealthsipmple Trade does not.

An RESP (Retirement Education Savings Plan) is a Canadian registered investment account, similar to an RRSP (registered retirement savings plan) or TFSA (tax-free-savings account), that parents can open for their children to help get a jump start on saving for their education.

5. No 24/7 Support

- Products: Invest, Trade, Crypto, Tax and Cash

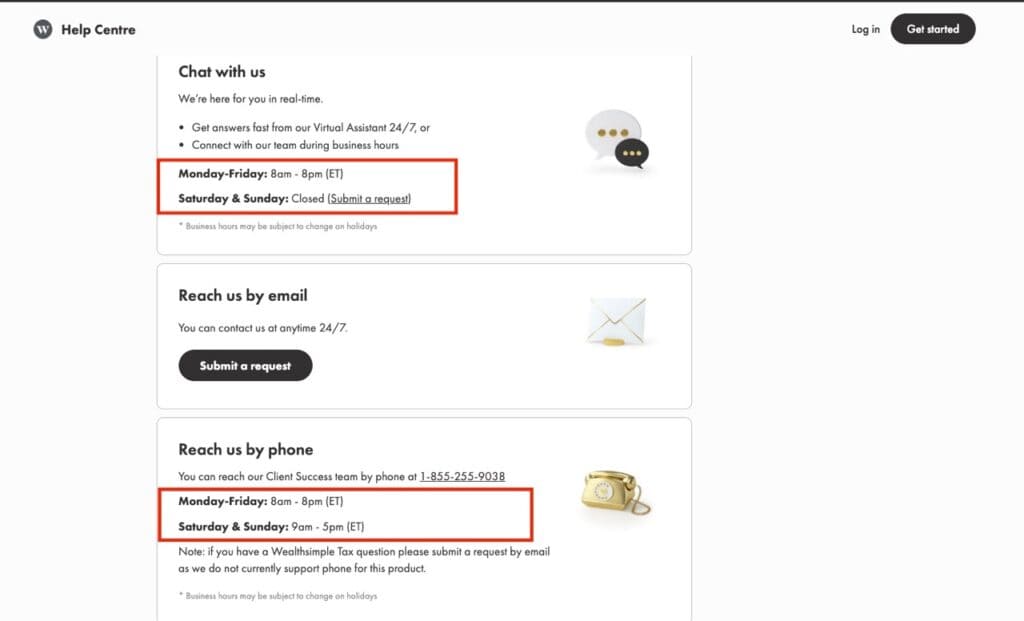

While I do find their customer support team to be super responsive, friendly and helpful, it’s important to note that they don’t offer 24/7 support [2].

You can, of course, send in an email through an online form or talk to a robot any time of the day or week, but there are only certain times you can speak to an actual human.

For real-time chat support on their website, they are available from Monday-Friday, 8 am – 8 pm (ET) and then close on weekends. Their phone support is available from Monday-Friday from 8 am – 8 pm (ET) and then Saturday & Sunday from 9 am – 5 pm (ET).

So it’s not horrible, but if you are someone who has a lot of money invested, you’d like to see them adopt 24/7 human support sometime in the future.

6. Desktop Platform Can Be Glitchy

- Products: Invest, Trade and Crypto

The Wealthsimple desktop platform is sleek, but if I’m being 100% transparent, it can be glitchy sometimes.

As someone who uses the Wealthsimple Trade app more than the desktop platform, this isn’t a huge deal, but the few times I do go on my trading account through the desktop, I noticed that it is slower, and updates can take longer to process.

With that said, in light of being completely transparent, I feel like it’s gotten much better over the last year or so.

7. No Expert Review On Wealthsimple Tax

- Product: Wealthsimple Tax

Unlike a lot of Wealthsimple’s Tax’s major competitors, they don’t offer expert reviews. In other words, you’re on your own.

Now luckily, Wealthsimple Tax is so easy to use, and most people won’t require special assistance to use the platform. But if you’re someone who will definitely need live agent support, well, then Wealthsimple Tax is not a good option for you, and I’d recommend checking out Turbotax.

8. No Overdraft On Wealthsimple Cash

- Product: Wealthsimple Cash

Wealthsimple Cash is a reloadable prepaid credit card, which means that you actually don’t get any overdraft protection [3]. In other words, you can only spend what you’ve transferred into your account, and if you try to spend more than what you have, your transaction will simply be declined.

This can definitely be a drawback and inconvenience for people who are used to relying on overdrafts to cover their expenses, but for those of us who do consistently go into overdraft, not having the option can actually be a positive aspect of Wealthsimple Cash as it’ll force you to limit the amount you can spend to only what you have available.

9. No Desktop Application On Wealthsimple Cash

- Product: Wealthsimple Cash

The last downside of Wealthsimple Cash is that it doesn’t yet have a desktop option – it’s strictly an app.

So if you like to have both or prefer desktop over mobile, this could be an issue for you. I prefer mobile, but I also like having a desktop option, so while it’s not a deal breaker for me by any means, it is something I’d like to see them include in the future as they have with their Invest, Trade and Crypto.

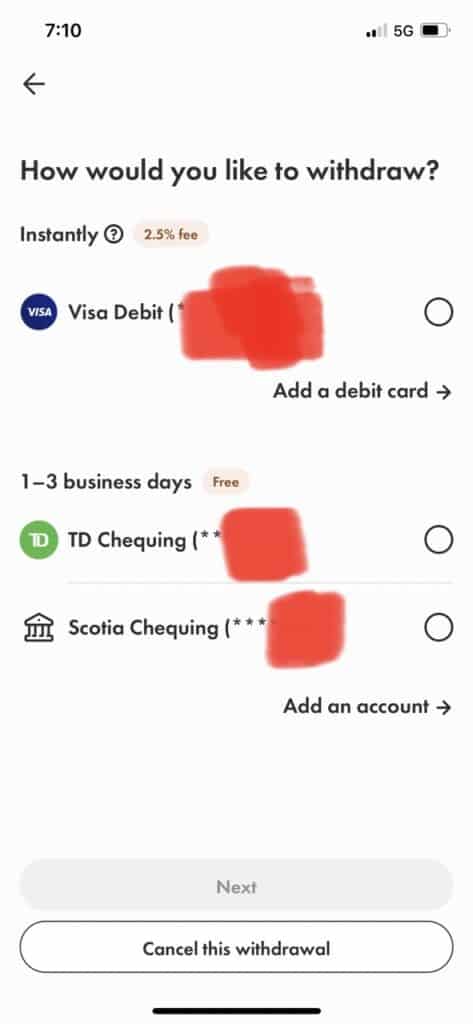

10. Wealthsimple Cash Instant Withdrawals Cost 2.5%

- Product: Wealthsimple Cash

We mentioned fees earlier, and I really do think Wealthsimple Cash does a great job of keeping fees to a minimum, but one thing they do charge is a 2.5% fee for instant withdrawals.

When you go to withdraw money from your cash account, you’ll be given two options if you have your debit card and bank account set up to your Wealthsimple account.

The 1st option will be an instant withdrawal to a debit card, which will cost 2.5% of your total withdrawal, and then the 2nd option is a free withdrawal through your external bank account, which will usually take 1-3 business days.

So if you’re withdrawing $1,000 from your account and want it instantly deposited into your bank account, then you’ll have to pay $25 for that, which is pretty steep, so it’s something to be aware of if you’ll be withdrawing a lot of money and you want to be able to access it instantly.

11. Only Available In Canada

- Products: Invest, Trade, Crypto, Tax, Cash

Another area where Wealthsimple doesn’t shine so hot (depending on who you ask) is its limited availability to non-Canadians. Actually, it’s not even limited; it’s no availability.

In other words, if you’re not a Canadian resident, you’re out of luck.

Now, if you’re reading this article, you’re probably a Canadian, so this won’t really impact your decision, but if you’re an international investor looking to use Wealthsimple, you simply won’t be able to.

12. Trading Fees Of 1.5% – 2% For Any Crypto Investments

- Product: Crypto

Wealthsimple Crypto’s trading fees can actually be seen as a drawback for some investors despite only being 1.5% – 2%.

While my crypto portfolio is somewhat small, I don’t feel the impact too much, but if you did, in fact, trade in massive volume, you likely would, so it’s definitely something to keep in mind. In the next section, I do a full breakdown here on how these crypto fees are calculated.

But basically, if you buy $100 worth of crypto, you’ll be charged $1.50 – $2.00.

Again, as someone who loves personal finance, this is not uncommon or that significant, but if you’re a serious crypto trader, you can see how these fees could eat away at your returns over time.

While Wealthsimple offers a seamless, user-friendly experience, their fees are actually a little bit more on the higher side, and volume traders who are really aiming to maximize their profits might find these fees too much.

13. Crypto Wallet Transfers Not Supported By All Coins

- Product: Crypto

Wealthsimple offers over 50 coins for users to trade. I also talked about how in 2022, Wealthsimple added crypto transferring functionality, so if you own Bitcoin in a Coinbase account (for example), you can now send that Bitcoin to your Wealthsimple Crypto wallet.

However, as of now, not all the coins you can trade within Wealthsimple Crypto are available for crypto transfer.

14. Funding Restricted To Canadian Dollars Only

- Product: Crypto

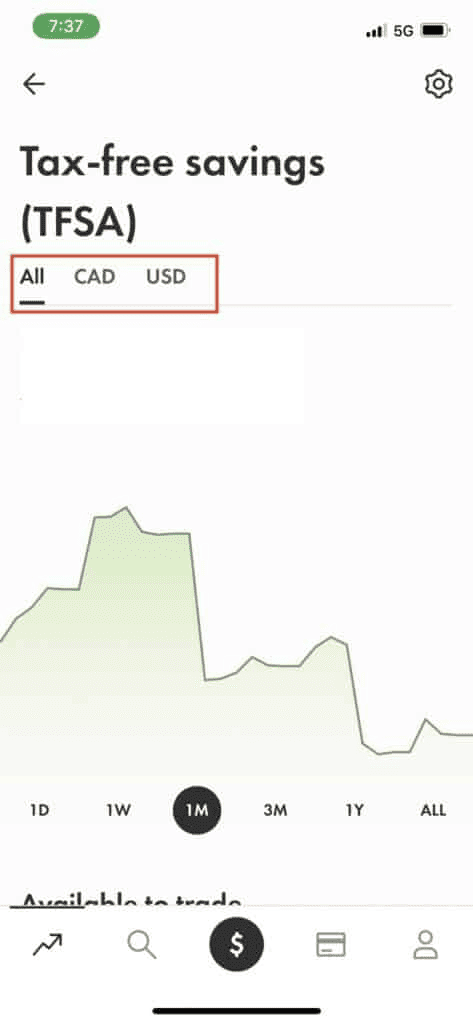

Another limitation I’ve personally experienced with Wealthsimple Crypto is the restriction to funding accounts using only Canadian dollars. So if you’re planning to fund your account with other currencies, you’ll face disappointment.

Unlike Wealthsimple Trade, Wealthsimple Crypto only offers Canadian accounts, so you can’t actually trade crypto with any other currency but Canadian dollars, which can be a little inconvenient for users who prefer to diversify their investments by holding multiple currencies.

On the other hand, for Canadian investors who exclusively deal in CAD, this won’t cause any significant issues. But it’s definitely something to be aware of if you’re considering Wealthsimple Crypto as a trading platform.

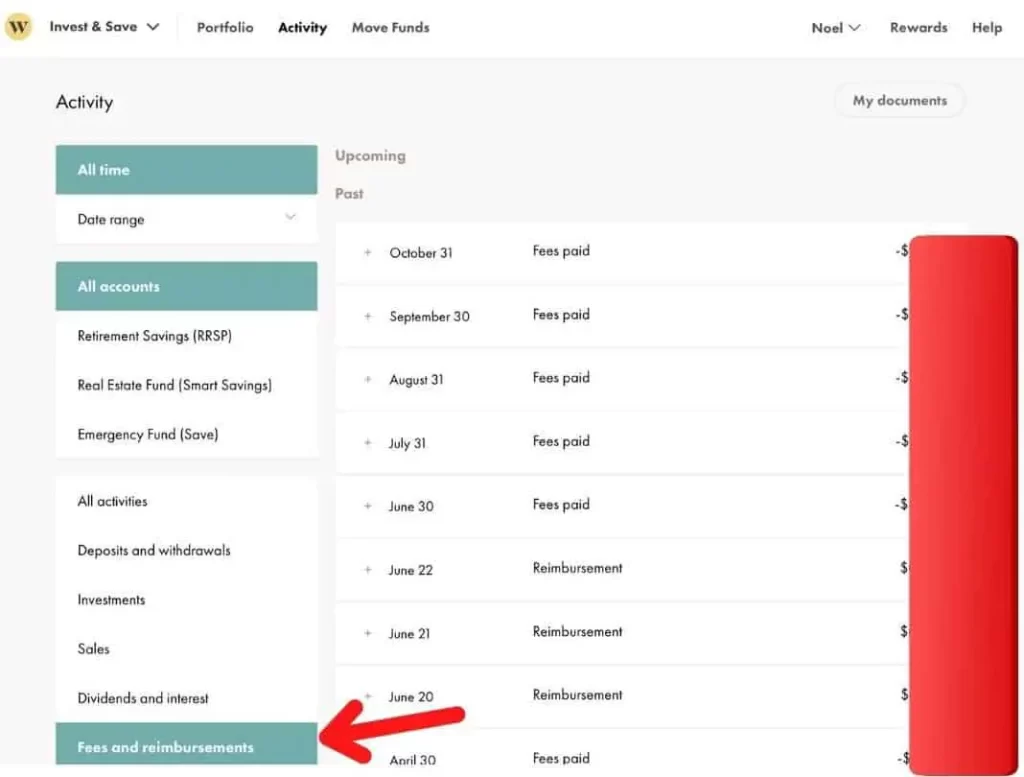

15. Wealthsimple Invest’s 0.5% Management Fees

Product: Invest

While Wealthsimple Invest’s management fees are competitive, they are a tad higher than what some of its competitors offer. (You can easily find your account maintenance fees in the activity tab.)

This slight difference in fees is worth considering for potential investors who are comparing various platforms in search of the best value for their money. However, it’s essential to weigh this fee against the array of services and the quality of the platform that Wealthsimple Invest provides.

For my in-depth Wealtshimple Review, check out my article.

![Can You Short on Wealthsimple? [And How Shorting Works]](https://noelmoffatt.com/wp-content/uploads/2023/07/can-you-short-on-Wealthsimple-1-768x327.jpg)

![Can I Use the Wealthsimple Cash Card Online? [in 2024]](https://noelmoffatt.com/wp-content/uploads/2023/09/Wealthsimple-Cash-Buying-Things-Online-768x384.jpg)

![Wealthsimple Tax Review for 2024 [Previously SimpleTax]](https://noelmoffatt.com/wp-content/uploads/2023/04/Wealthsimple-Tax-Review-1-768x384.jpg)

![Can You Buy GICs on Wealthsimple? [Here are the Facts]](https://noelmoffatt.com/wp-content/uploads/2023/08/Buy-GIC-Wealthsimple-1-768x327.jpg)