Wealthsimple RRSP Review | Canada’s Best Retirement Account

Key Takeaways

1. Tax Advantages

You can benefit from tax deductions on contributions and tax-free investment income growth, making it a great tool for long-term savings.2. Easy Setup and Use

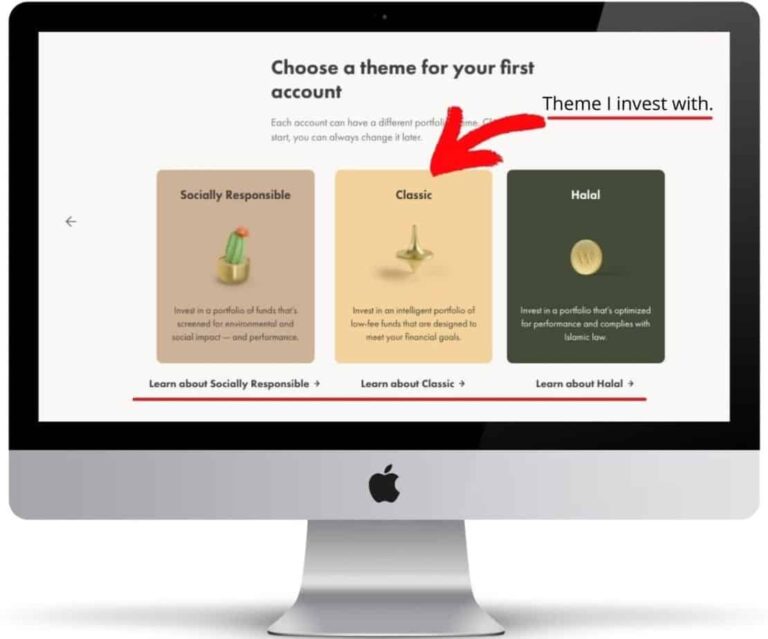

The sign-up process is straightforward and takes about 20 minutes. Their user-friendly interface and mobile app ensure accessibility and ease of use.3. Flexible Investment Options

Beyond traditional investing, Wealthsimple offers specialized investment themes, such as Socially Responsible and Halal.4. Clear Fee Structure

The platform’s fees are based on the amount you have invested, with three distinct brackets ensuring clarity and transparency.5. Secure and Regulated

Operates under the regulation of IIROC and provides security measures equivalent to banks, making it safe for users to invest and store their data.

Main Pros and Cons of Wealthsimple RRSP

- Contributions to RRSP are tax-deductible.

- User-friendly, modern investing experience

- No account minimum – start with $1

- Tax-free growth of investment income

- Option to use RRSP for home down payment

- Low management fees

- Provides tools for passive investing based on risk preference.

- You have less control with -passive investing.

- No 24/7 customer support.

- Cannot reclaim RRSP withdrawals

- RRSP withdrawals can affect certain government benefits like OAS or GIS.

- RRSP contribution limits are based on gross income, which can disadvantage those with lower incomes.

What is a Wealthsimple RRSP?

In short, an RRSP is a registered investment account that is offered by the CRA to help Canadians save money for retirement. And the RRSP issuer, in this case, is, of course, none other than Wealthsimple.

It’s important to note that an RRSP in itself is not an investment, but it’s like a bucket in which you can hold your investments and get tax benefits [1] for doing so.

Back in 2018, I actually opened up my first investment account with Wealthsimple. I had just graduated from business school, but I really didn’t know much about investing. Despite not really knowing what an RRSP was, I had heard the term before and knew I should at least have one.

Luckily for me, I stumbled across a Wealthsimple app ad on Google and decided to give it a try. 5 years later, I still have my RRSP open with Wealthsimple.

Keep reading to uncover my comprehensive insights on Wealthsimple’s RRSP and discover how it might be the perfect fit for you.

Important Note

A Wealthsimple Invest account is Wealthsimple’s automated investment product which is a much more hands-off style of investing, which some people love. However, if you’re someone who wants to manage your entire Wealthsimple portfolio yourself by buying and selling individual stocks and ETFs, then you’ll want to set up an account with Wealthsimple’s online brokerage product on the Wealthsimple Trade app.

Learn More about Wealthsimple Trade and How It Differs From Wealthsimple Invest in my article here.

Wealthsimple RRSP Review | Comprehensive Analysis

As we delve into the pros and cons of a Wealthsimple RRSP, it’s crucial to differentiate between factors attributable to Wealthsimple as an issuer and inherent characteristics of the RRSP account type itself. For instance, the fact that withdrawals aren’t tax-free in an RRSP isn’t a shortcoming of Wealthsimple, but rather a feature of the RRSP structure.

Pros

Cons

Does a Wealthsimple Account Charge Management Fees For RRSPs?

Let’s now break down potential Wealthsimple fees (or taxes) you’ll come across if you have an RRSP open with Wealthsimple Invest; if you want to learn more about fees charged by Wealthsimple Trade, check out my article.

In my opinion, one of the standout features of Wealthsimple Invest lies in its user-friendly nature. But nevertheless, Wealthsimple, like all financial entities, has to generate income, and they achieve this by imposing a set management fee structure on their clients’ investment accounts.

Grasping these costs is fundamental for wise investment choices. So here’s a straightforward breakdown of the fees associated with having an RRSP open Wealthsimple Invest.

Cost Breakdown

Your management fee on Wealthsimple Invest is contingent on the amount you’ve invested. The platform offers three distinct brackets:

- Core

- Premium

- Generation

Below are Wealthsimple’s Management fees

| Plan | Amount Invested in Your RRSP | Management Charge |

|---|---|---|

| Core | Starting at $1 – $99,999 | 0.5% |

| Premium | $100,000 – $499,999 | 0.4% |

| Generation | $500,000 | 0.2% – 0.4% |

These yearly charges are billed monthly.

Fee Illustration

For instance, if you’ve invested $50,000, you belong to the ‘Core’ bracket, and your fees would be:

- $50,000 x 0.5% = $250 annually, or roughly $20.83 monthly.

For the ‘Premium’ category, with an investment minimum balance of, for example, $150,000, the fee is:

- $150,000 x 0.4% = $600 annually or approximately $50 each month.

Considering the ‘Generation’ category and an investment of $1,000,000 with a 0.3% fee, it equates to:

- $1,000,000 x 0.3% = $3,000 annually, or $250 monthly.

These charges are seamlessly extracted from your account’s balance.

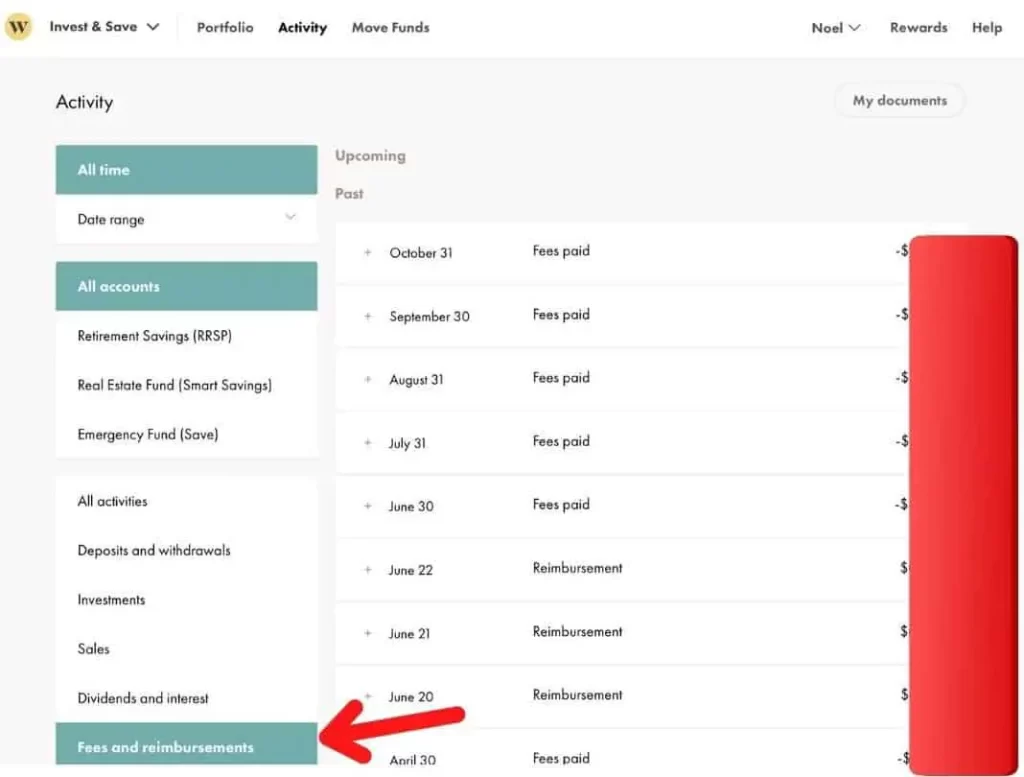

Accessing Your Wealthsimple Invest Fees

To observe the fees on Wealthsimple Invest, go to the “Activity” tab in your account.

From there, you’ll be able to select which account you want to look at information for (RRSP in this case), and then, you’ll select the activity type, which will be the account fees and reimbursements.

This will provide you with a comprehensive view of all expenses linked to your account, ensuring you’re always informed about your portfolio’s management costs.

My Experience With A Wealthsimple RRSP

Over the past half-decade, I’ve explored, tinkered with, and integrated numerous fintech tools into my life. Among all of the platforms I’ve used, my RRSP with Wealthsimple Invest is definitely the one I have the most money in and have the most experience with – my in-depth review of Wealthsimple Invest is here. (used since 2018)

I know basically everything you can know about the platform – not because I’ve tested it for a month or two, but because I’ve actually used the product and watched my retirement wealth grow with them over time AND witnessed how the software (and the company) has innovated and advanced every year.

So you won’t be shocked when I say I’ve had an awesome experience with having an RRSP open with Wealthsimple Invest for over the last half-decade.

One of the other things I like most about the platform is its user-friendliness for beginners, its lack of high fees, and its transparency from a company and an investment perspective.

When speaking with customer support, you don’t feel you are being sold to or viewed as a “ potential prospect.” They’re just trying to help as quickly as possible, and from my experience, they are always super pleasant and helpful.

And lastly, I just love how Wealthsimple makes everything simple – from the signup process to connecting your bank to making investments and viewing your returns, it’s really SO much easier and quicker than setting up and managing an RRSP with, say, a CIBC or BMO.

Open an RRSP with Wealthsimple Today

Eager to see your money grow for retirement? Open an RRSP Today.

How to Open a Wealthsimple RRSP

Time needed: 20 minutes

Opening up an RRSP with Wealthsimple is a super straightforward process. Follow this step-by-step guide, and you’ll be set up in no time at all.

- Create a Wealthsimple Profile

First, visit Wealthsimple’s sign-up page. You’ll set up your account by entering your email address and generating a password.

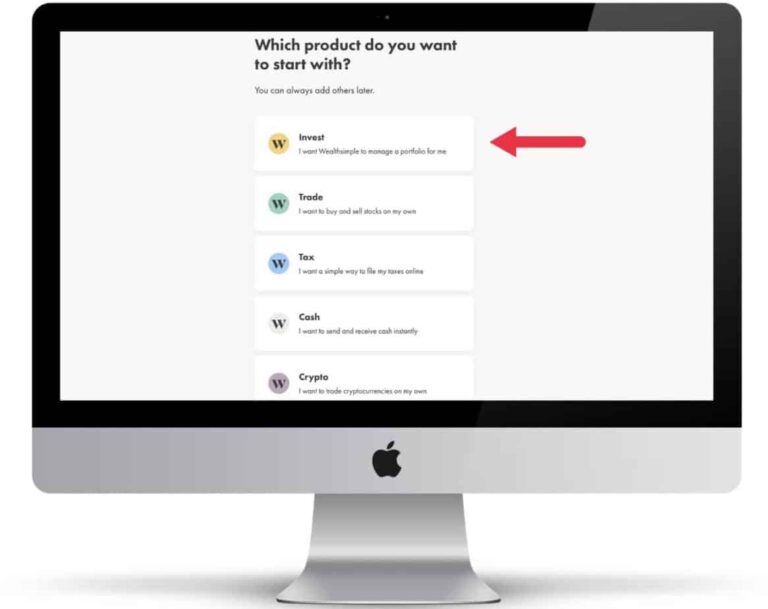

Select “Invest” as your starting product (or Wealthsimple Trade if you want direct investing)

Then you’ll be asked to provide the following details:

1. First Name

2. Last Name

3. Date of Birth

4. Phone Number

5. Citizenship

6. Gender (Optional)

7. Residential Address

8. Mailing Address

9. Employment Status

10. Current Workplace

11. Type of Company

12. Your Role at the Company

13. Social Insurance Number (SIN)

Remember that Wealthsimple, just like big Canadian banks, is regulated by IIROC, so rest assured it’s safe to provide your SIN and other personal details. - Personalize Your Portfolio

Now you’ll answer a series of questions to better help Wealthsimple customize your portfolio to your preferences and risk tolerance.

QueNow you’ll answer a series of questions to better help Wealthsimple customize your portfolio to your preferences and risk tolerance.

Questions include:

1. Are you thinking about retirement?

2. What’s the main reason for investing?

3. When would you like to retire?

4. What’s your estimated household income for this year?

5. How much money do you have saved?

6. What’s the value of property and other assets you own?

7. What’s the value of your debts?

8. How much do you know about investing?

9. Do you have an idea of how much risk you’re willing to take?

10. Choose an investment theme for your account (Socially Responsible Investing, Classic Investing or, Halal Investing)

After you’ve answered these questions, Wealthsimple suggests a portfolio type. Remember, though, you’re not locked into this, and you can adjust your risk preferences in your settings at any point after you’ve signed up. - Open Your Wealthsimple Account

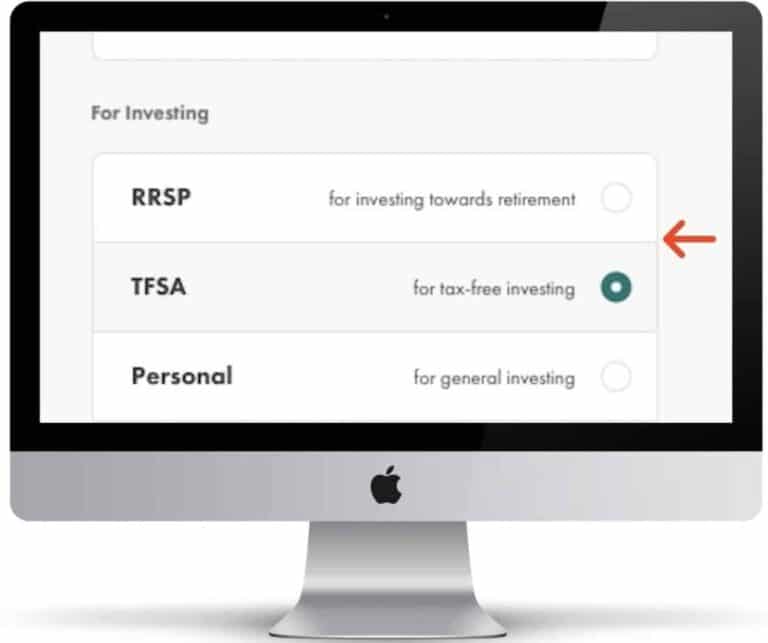

It’s now time to open your account. You’ll first indicate whether you’re transferring an existing RRSP account or starting a new one. For new users, select “No, I’ll start with a new Wealthsimple account.”

Then, choose the type of account you want to open, which of course, will be an RRSP.

You’ll then you’ll select the goals for your new RRSP and agree to its terms and conditions.

- Fund Your Wealthsimple RRSP

Finally, you’ll now link your bank account to Wealthsimple and fund your investment account. Connecting your bank to Wealthsimple is super safe, and the platform connects to all major banks in Canada.

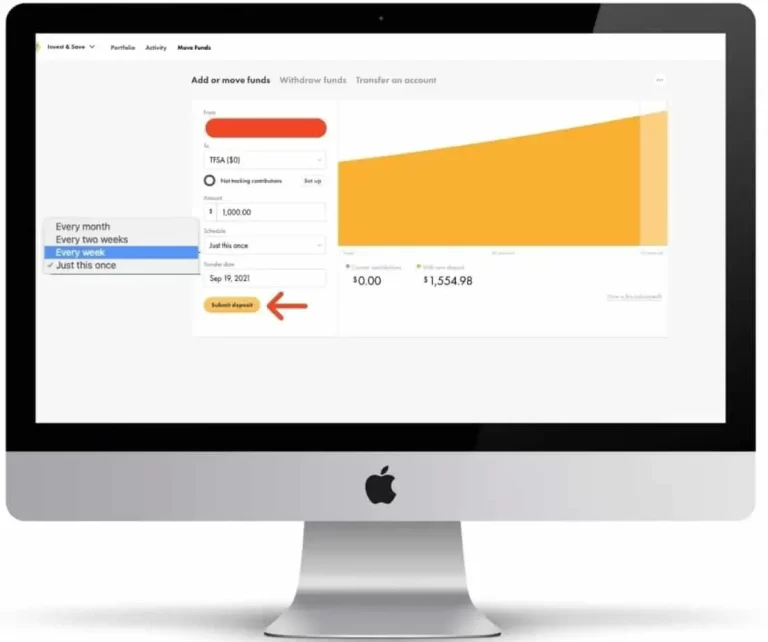

Once you’ve linked your bank account, you can schedule a deposit by following these steps:

1. Ente the amount you wish to deposit

2. Schedule the deposit for a one-time transaction, or weekly, bi-weekly, or monthly

3. Select your deposit date

Now click “Submit deposit.” It usually takes 3-5 business days for deposits to process.

And there you go, you’ve officially set up and funded an RRSP with Wealthsimple.

Open a RRSP with Wealthsimple Today

Eager to see your money grow for retirement? Open an RRSP Today.

Final Verdict

I give Wealthsimple RRSP accounts a glowing review and a 4.5/5 star rating for everything mentioned above. If you’re still not sure about signing up, I would say there is no harm (or cost or account minimums either) in giving it a try. If it works for you, then great. If not, it takes 30 seconds (and no cost) to delete your account and move on with your life – but at least then, you’ll know one way or another.

FAQs About Wealthsimple And RRSPs

Are Wealthsimple Investment Accounts Trustworthy?

Both Wealthsimple Invest and Wealthsimple Trade are trustworthy platforms. The company is not only relied upon by over 1.5 million users in Canada but also manages more than $15 billion in assets, and it implements industry-leading security protocols to ensure user safety.

What Is Wealthsimple’s RRSP Withdrawal Fee?

When you withdraw from your RRSP with Wealthsimple before reaching retirement or before converting it to a registered retirement income fund (RRIF), you’ll incur an RRSP withholding tax. The rates are 10% for withdrawals up to $5,000, 20% for withdrawals between $5,000 to $15,000, and 30% for any withdrawal over $15,000.

Is It Better To Put Money In TFSA Or RRSP?

TFSAs offer more flexibility than RRSPs and allow for tax-free investment income. Since the funds you contribute to a TFSA have already been taxed, both your principal and any earnings can be withdrawn at any time, for any reason, without incurring additional taxes.

What is the Canadian Investor Protection Fund?

The Canadian Investor Protection Fund (CIPF) [2] is a non-profit organization established to protect investors from the insolvency of their investment firm. If a CIPF member firm becomes insolvent, the CIPF ensures that customers’ securities, cash balances, and other property are returned to them, subject to certain limits.

What is the Investment Industry Regulatory Organization

The Investment Industry Regulatory Organization (IIROC) [3] is a non-governmental regulatory body responsible for overseeing all investment dealers and trading activity on debt and equity marketplaces in Canada. IIROC sets and enforces industry standards to protect investors and ensure the integrity of the financial markets.

![Can I Use the Wealthsimple Cash Card Online? [in 2024]](https://noelmoffatt.com/wp-content/uploads/2023/09/Wealthsimple-Cash-Buying-Things-Online-768x384.jpg)

![Can You Buy Index Funds on Wealthsimple? [And How To Do It]](https://noelmoffatt.com/wp-content/uploads/2023/08/Can-You-Buy-Index-Funds-on-Wealthsimple.jpg)

![Can You Buy Gold on Wealthsimple? [January 2024 Update]](https://noelmoffatt.com/wp-content/uploads/2023/08/Can-You-Buy-Gold-on-Wealthsimple-2.jpeg)

![Wealthsimple Pros And Cons for 2024 [My Honest Take]](https://noelmoffatt.com/wp-content/uploads/2023/09/wealthsimple-pros-and-cons-768x538.jpg)